Recent Articles from MarketMinute

MarketMinute is a dynamic online platform dedicated to delivering real-time stock news and market insights to investors and enthusiasts alike. Operated by FinancialContent, a leading digital publisher in financial news, the website offers up-to-the-minute updates on stock movements, corporate earnings, analyst ratings, and macroeconomic trends that shape the financial landscape.

Website: https://www.marketminute.com

The Dow Jones Industrial Average (DJIA) suffered a punishing blow today, March 5, 2026, as a "perfect storm" of geopolitical escalation and technical exhaustion forced the index to surrender its hard-fought 49,000 level. After weeks of struggling to maintain a foothold above this psychological and structural resistance zone, the

Via MarketMinute · March 5, 2026

As of March 5, 2026, the United States labor market has entered a peculiar state of equilibrium that economists are calling a "low-hire, low-fire" freeze. With the Federal Reserve’s next interest rate decision just two weeks away, investors are hyper-focused on the delicate balance between cooling job growth and

Via MarketMinute · March 5, 2026

As of March 5, 2026, the global financial landscape is grappling with a tectonic shift in capital flows as China’s major financial institutions continue a systematic retreat from the U.S. Treasury market. Recent data confirms that China’s holdings of American sovereign debt have plummeted to levels not

Via MarketMinute · March 5, 2026

As of March 5, 2026, the North American midstream sector is watching a transformation unfold within one of its largest players. After years of aggressive acquisitions and a complex dance with large-scale liquefied natural gas (LNG) ambitions, Energy Transfer (NYSE: ET) is entering a phase that Wall Street analysts are

Via MarketMinute · March 5, 2026

As the global demand for artificial intelligence infrastructure enters a new, more intensive phase, Ciena (NYSE:CIEN) has positioned itself at the epicenter of the hardware revolution. In its latest financial disclosures released this week, the networking giant confirmed an ambitious revenue target for fiscal year 2026, projecting a range

Via MarketMinute · March 5, 2026

The S&P 500 index faced a harsh reality check on March 5, 2026, as it decisively failed to breach the 6,900 resistance level, tumbling into negative territory for the year. This reversal marks a significant shift in market sentiment, erasing the modest gains of early 2026 and signaling

Via MarketMinute · March 5, 2026

In a week that has sent shockwaves through the American economy, retail gasoline prices have surged by a staggering 9%, the sharpest weekly increase in nearly four years. As of March 5, 2026, the national average for a gallon of regular unleaded has hit $3.25, up from just $2.

Via MarketMinute · March 5, 2026

NEW YORK — The euphoric "small-cap comeback" that defined the opening weeks of 2026 came to a grinding halt on Thursday. The Russell 2000 index, the primary barometer for American small-cap health, plummeted 1.9% on March 5, 2026, marking its sharpest single-day decline of the year. The sell-off, triggered by

Via MarketMinute · March 5, 2026

In the opening months of 2026, the technology sector witnessed a dramatic "tale of two tapes." Driven by monumental breakthroughs in autonomous "agentic" AI from Meta Platforms Inc. (NASDAQ: META) and the private heavyweight Anthropic, tech stocks initially surged to record highs, fueled by the promise of AI that could

Via MarketMinute · March 5, 2026

The semiconductor giant Nvidia (NASDAQ: NVDA) found itself at the center of a market storm this week as its stock plummeted 5.5% in a single trading session, despite delivering what analysts called a "triple beat" in its fiscal fourth-quarter earnings report. The drop, which occurred on February 26, 2026,

Via MarketMinute · March 5, 2026

The global energy landscape is currently facing its most severe crisis in decades following the escalation of military hostilities in the Persian Gulf. As of March 5, 2026, the Strait of Hormuz—the world’s most critical maritime chokepoint—has become a de facto closed corridor for commercial shipping. This

Via MarketMinute · March 5, 2026

In a resounding display of market confidence that underscores the intensifying arms race in artificial intelligence, Alphabet Inc. (NASDAQ: GOOGL) successfully closed a massive $20 billion bond sale in early February 2026. The offering, which initially targeted $15 billion but was upsized due to overwhelming institutional interest, drew a staggering

Via MarketMinute · March 5, 2026

NEW YORK — In a move that has sent ripples through a resurgent Wall Street, Morgan Stanley (NYSE:MS) announced this week its plan to slash approximately 3% of its global workforce. The reduction, affecting roughly 2,500 employees, comes at a paradoxical moment for the banking giant: just months after

Via MarketMinute · March 5, 2026

The digital asset market experienced a seismic shift this week as a coordinated legislative push from the White House sparked a massive "Trump Pump" across cryptocurrency-related equities. On March 4, 2026, President Donald Trump took to social media and official channels to demand that Congress immediately pass the Digital Asset

Via MarketMinute · March 5, 2026

In a historic move that effectively ends a half-decade of regulatory ambiguity, the U.S. Congress has finalized a landmark legislative package designed to bring the $160 billion stablecoin market under federal oversight. The breakthrough—anchored by the GENIUS Act signed last summer and the newly finalized CLARITY Act—establises

Via MarketMinute · March 5, 2026

NEW YORK — The Dow Jones Industrial Average (DJIA) endured one of its most turbulent sessions in recent memory on Thursday, March 5, 2026, closing down 784 points after a day defined by extreme intraday volatility. At its lowest point during the late morning session, the blue-chip index had plummeted more

Via MarketMinute · March 5, 2026

The traditional laws of safe-haven investing were rewritten this week as a sudden escalation in Middle Eastern conflict sent shockwaves through the global economy. In a move that defied decades of market logic, the yield on the benchmark 10-year U.S. Treasury note spiked to 4.132% on March 5,

Via MarketMinute · March 5, 2026

The airline industry faced a grueling session on Thursday, March 5, 2026, as a sudden and dramatic escalation in Middle Eastern geopolitical tensions sent jet fuel prices to multi-year highs. The resulting sell-off erased billions in market capitalization across the sector, casting a long shadow over what was previously predicted

Via MarketMinute · March 5, 2026

Global energy markets were sent into a tailspin on March 5, 2026, as escalating military tensions in the Middle East sparked fears of a prolonged supply disruption. West Texas Intermediate (WTI) crude, the U.S. benchmark, surged a staggering 8.5% to settle at $81.01 per barrel, while the

Via MarketMinute · March 5, 2026

In a trading session defined by red ink and rising geopolitical anxieties, Broadcom Inc. (NASDAQ: AVGO) emerged as a singular beacon of resilience. The semiconductor giant saw its shares climb 4.8% on March 5, 2026, a sharp divergence from a broader market that buckled under the weight of escalating

Via MarketMinute · March 5, 2026

The S&P 500 (NYSEARCA: SPY) experienced a significant technical breakdown on March 5, 2026, as a convergence of escalating geopolitical tensions and stubborn inflationary data forced the index below critical support levels. After months of resilient trading, the benchmark index slipped through its 100-day moving average of 6,835,

Via MarketMinute · March 5, 2026

In a bold move to navigate through a turbulent macroeconomic climate, Malibu Boats Inc. (NASDAQ: MBUU) announced on March 2, 2026, the acquisition of Helsinki-based Saxdor Yachts for a total consideration of approximately $175 million (€150 million). This strategic pivot marks a significant departure from Malibu’s traditional focus on

Via MarketMinute · March 5, 2026

The recent move by a top executive at one of the world’s most recognizable brands has captured the attention of Wall Street. Nancy Quan, Executive Vice President and Chief Technical & Innovation Officer for The Coca-Cola Company (NYSE: KO), sold approximately $1.87 million in common stock on March 3,

Via MarketMinute · March 5, 2026

In a move that has sent ripples through the precious metals market, Pan American Silver Corp. (NYSE: PAAS; TSX: PAAS) announced today, March 5, 2026, the discovery of four new high-grade silver veins and a substantial breccia zone at its flagship La Colorada mine in Zacatecas, Mexico. The discovery, concentrated

Via MarketMinute · March 5, 2026

As the artificial intelligence boom enters its third year of breakneck expansion, a shadow is beginning to stretch across the industry’s balance sheets. A growing chorus of analysts and short-sellers are sounding the alarm over "circular financing"—a practice where the world’s largest technology firms invest billions into

Via MarketMinute · March 5, 2026

The board of British engineering stalwart Senior PLC (LSE: SNR) has today, March 5, 2026, formally rejected a £1.14 billion ($1.52 billion) unsolicited takeover proposal from U.S. private equity titan Advent International. The rejection marks a significant escalation in the battle for control over the UK’s

Via MarketMinute · March 5, 2026

In a bold move to reassure investors and capitalize on what it describes as "market dislocation," Zillow Group (NASDAQ: Z) announced today, March 5, 2026, that its Board of Directors has authorized an additional $1.25 billion for its share repurchase program. The expansion comes at a critical juncture for

Via MarketMinute · March 5, 2026

In a move that has sent ripples through both the music industry and global financial hubs, Universal Music Group (Euronext: UMG) officially announced on March 5, 2026, that it has indefinitely suspended its plans for a secondary listing on a United States stock exchange. The decision, revealed alongside the company’

Via MarketMinute · March 5, 2026

The "sell the news" fever that has gripped AI-adjacent technology stocks claimed its latest victim on March 5, 2026. Ciena Corp (NYSE: CIEN), a leader in optical networking and the "plumbing" of the modern internet, saw its stock price plunge over 14% in heavy intraday trading. This sharp decline came

Via MarketMinute · March 5, 2026

On March 5, 2026, the global financial landscape is witnessing a historic fracture in the traditional relationship between geopolitical risk and safe-haven assets. US Treasury yields have surged to multi-month highs, with the benchmark 10-year Treasury note climbing to 4.14%, as investors find themselves trapped in a violent "tug-of-war.

Via MarketMinute · March 5, 2026

The meteoric rise of silver (XAG/USD) has hit a formidable wall today, March 5, 2026, as the precious metal saw its steepest single-day decline in over two years. After a historic 2025 that saw prices touch an astronomical $120 per ounce, silver plunged nearly 9% in early morning trading,

Via MarketMinute · March 5, 2026

In a decisive move to stabilize its balance sheet and sharpen its operational focus, Six Flags Entertainment Corporation (NYSE: FUN) announced today, March 5, 2026, a definitive agreement to sell seven of its regional properties to EPR Properties (NYSE: EPR) for $331 million. The divestiture, which includes the iconic Six

Via MarketMinute · March 5, 2026

The ambitious push for a comprehensive federal framework for digital assets hit a significant roadblock today, March 5, 2026, as the Digital Asset Market Clarity Act (CLARITY Act) stalled in the Senate. The impasse followed a high-stakes rejection by a coalition of the nation’s largest financial institutions of a

Via MarketMinute · March 5, 2026

As the closing bell approaches on March 5, 2026, all eyes on Wall Street are fixed on Marvell Technology (NASDAQ:MRVL), which is set to report its fiscal fourth-quarter 2026 earnings after the market close. In a trading session characterized by heightened sensitivity to artificial intelligence (AI) capital expenditure, Marvell

Via MarketMinute · March 5, 2026

While the rest of the financial markets were painted in deep shades of red on March 5, 2026, identity management giant Okta Inc. (NASDAQ: OKTA) emerged as a singular beacon of growth. Following a robust fourth-quarter earnings report released after the bell on March 4, the company’s stock soared

Via MarketMinute · March 5, 2026

As the first quarter of 2026 draws to a close, a seismic shift in investor sentiment has fundamentally reshaped the landscape of the New York Stock Exchange and the Nasdaq. After three years of relentless enthusiasm for artificial intelligence software and generative models, the market has entered what analysts are

Via MarketMinute · March 5, 2026

On March 5, 2026, the United States housing market witnessed one of its most dramatic single-day shifts in recent history. The 30-year fixed-rate mortgage plummeted by 63 basis points, officially touching the psychologically critical 6.00% mark. This sudden correction has effectively ended the "higher-for-longer" era that paralyzed the real

Via MarketMinute · March 5, 2026

The global financial landscape has been upended this week as the US Dollar surged to its strongest weekly performance since 2022. As of today, March 5, 2026, the greenback has become the ultimate "safe-haven" asset following a massive escalation in geopolitical tensions. The catalyst for this move was the launch

Via MarketMinute · March 5, 2026

The global energy landscape shifted violently today, March 5, 2026, as Brent and WTI crude prices spiked toward the $80 mark, driven by a rapid escalation in military conflict between a U.S.-led coalition and Iran. Following days of mounting tension in the Persian Gulf, the markets reacted with

Via MarketMinute · March 5, 2026

The Dow Jones Industrial Average (INDEXDJX: .DJI) suffered one of its most punishing sessions in recent history today, March 5, 2026, plunging more than 1,000 points as a sudden and sharp escalation in the Middle East sent shockwaves through global financial markets. The sell-off was triggered by reports of

Via MarketMinute · March 5, 2026

As of early March 2026, the long-standing dominance of the S&P 500 (NYSEARCA: VOO) has met its most significant challenge in nearly a decade. For the first time since the mid-2010s, international equity markets are not just keeping pace with their American counterparts but are decisively outperforming them. While

Via MarketMinute · March 5, 2026

WASHINGTON, D.C. — In a landmark decision that has sent shockwaves through global supply chains and the halls of K Street, the U.S. Supreme Court has dealt a significant blow to executive trade authority. As of today, March 5, 2026, the financial markets are reacting to a dual-pronged development:

Via MarketMinute · March 5, 2026

As of March 5, 2026, the technology sector is undergoing a massive "Second Wave" of growth, driven by a fundamental shift from experimental artificial intelligence to the deployment of autonomous "AI Agents." This transition, spearheaded by recent breakthroughs from Meta and Anthropic, has catalyzed a significant market rebound, pushing the

Via MarketMinute · March 5, 2026

The financial world witnessed an unprecedented surge in market activity last month as CME Group (NASDAQ: CME) reported a staggering record for monthly average daily volume (ADV). Reaching an all-time high of 37.6 million contracts in February 2026, the exchange saw a 14% increase compared to the same period

Via MarketMinute · March 5, 2026

The Federal Reserve’s March 2026 Beige Book, released yesterday, paints a picture of a U.S. economy caught between a burgeoning technological revolution and new protectionist headwinds. While seven of the twelve Federal Reserve districts reported slight to moderate growth, the remaining five districts saw activity flatten or decline,

Via MarketMinute · March 5, 2026

In a move that has sent shockwaves through the global entertainment landscape, the newly formed Paramount Skydance Corporation (NASDAQ: PSKY) announced on February 27, 2026, a definitive agreement to acquire Warner Bros. Discovery (NASDAQ: WBD) in an all-cash transaction valued at approximately $110 billion in enterprise value. The deal, which

Via MarketMinute · March 5, 2026

In a move that has sent shockwaves through the media landscape, Netflix (NASDAQ: NFLX) officially confirmed on February 27, 2026, that it has received a staggering $2.8 billion termination fee following the collapse of its high-profile merger agreement with Warner Bros. Discovery (NASDAQ: WBD). The payment, settleable in cash,

Via MarketMinute · March 5, 2026

The retail landscape in early 2026 is proving to be a tale of two consumers, but for companies positioned at the intersection of necessity and value, business is booming. This week, the market received a definitive signal of consumer resilience as two industry titans, AutoZone (NYSE: AZO) and Ross Stores

Via MarketMinute · March 5, 2026

The high-growth software sector was sent into a tailspin this week as MongoDB (NASDAQ: MDB), a cornerstone of the modern cloud database market, saw its shares plunge by more than 25%. The dramatic sell-off, which wiped out billions in market capitalization in a single trading session, followed the company’s

Via MarketMinute · March 5, 2026

In a move that underscores the relentless capital intensity of the artificial intelligence revolution, Vertiv (NYSE: VRT) has finalized a massive $4.6 billion liquidity overhaul. Completed on March 4, 2026, the financing package marks a transformative moment for the thermal and power management giant, transitioning its capital structure to

Via MarketMinute · March 5, 2026

As of March 5, 2026, the American consumer is standing at a critical crossroads. Following a period of historic market highs and cooling inflation, the latest retail indicators for January suggest that while the broader economy remains resilient, the "K-shaped" recovery has deepened. With official government data delayed until tomorrow,

Via MarketMinute · March 5, 2026

As the sun rises on March 5, 2026, Wall Street is bracing for one of the most consequential economic data points of the year. Tomorrow’s release of the February Nonfarm Payrolls (NFP) report by the Bureau of Labor Statistics comes at a precarious moment for the U.S. economy.

Via MarketMinute · March 5, 2026

In a decisive move to reclaim its position as the premier "cheap-chic" destination for American consumers, Target Corporation (NYSE: TGT) unveiled its comprehensive 2026 strategic roadmap during its annual Financial Community Meeting in Minneapolis on March 3, 2026. Under the leadership of newly minted CEO Michael Fiddelke, who took the

Via MarketMinute · March 5, 2026

CHARLOTTE, N.C. – March 5, 2026 – In a definitive move to dismantle its century-old conglomerate structure, Honeywell International Inc. (Nasdaq: HON) has reached a critical milestone in its multi-year transformation. On March 3, 2026, the industrial giant filed its Form 10 registration statement with the U.S. Securities and Exchange

Via MarketMinute · March 5, 2026

In a landmark resolution that removes a multi-year shadow over the messenger RNA (mRNA) industry, Moderna, Inc. (NASDAQ:MRNA) has reached a comprehensive $2.25 billion global settlement with Genevant Sciences and Arbutus Biopharma (NASDAQ:ABUS). Announced on March 3, 2026, the deal concludes one of the most contentious patent

Via MarketMinute · March 5, 2026

The global credit markets have delivered a resounding vote of confidence in the future of artificial intelligence, as Alphabet Inc. (NASDAQ: GOOGL) successfully raised $20 billion through a massive U.S. dollar bond sale that saw investor demand exceed $100 billion. The offering, which closed in late February and has

Via MarketMinute · March 5, 2026

In a landmark moment for the retail sector, Costco Wholesale Corporation (NASDAQ:COST) reported its fiscal second-quarter 2026 earnings today, March 5, 2026, officially cementing its status as the premier performer in the consumer staples market. The warehouse giant blew past analyst expectations, fueled by a surge in digital sales

Via MarketMinute · March 5, 2026

As the sun sets on the first quarter of 2026, all eyes in Silicon Valley and on Wall Street are turning toward Marvell Technology (NASDAQ: MRVL). The semiconductor powerhouse is scheduled to release its fourth-quarter fiscal year 2026 earnings today, March 5, after the market close. This report is being

Via MarketMinute · March 5, 2026

Broadcom Inc. (NASDAQ: AVGO) delivered a powerful signal to the financial markets on March 4, 2026, reporting fiscal first-quarter earnings that surpassed analyst expectations and underscored its pivotal role in the second wave of the artificial intelligence (AI) revolution. As the market entered 2026, investors were laser-focused on whether the

Via MarketMinute · March 5, 2026

The global financial landscape was upended this week as escalating military conflict in the Middle East triggered a violent 7% surge in crude oil prices, forcing investors to recalibrate their expectations for inflation and monetary policy. As of March 5, 2026, the sudden volatility has shattered the relative calm of

Via MarketMinute · March 5, 2026

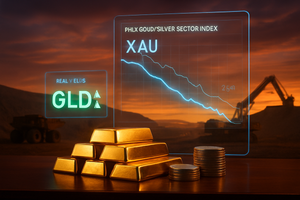

The precious metals sector has staged a remarkable rally in early March 2026, as the PHLX Gold/Silver Sector Index (XAU) tests historic highs amid a massive influx of institutional capital. Driven by a significant decline in inflation-adjusted "real" yields, investors have aggressively rotated into gold-backed assets, resulting in over

Via MarketMinute · March 5, 2026

As the first quarter of 2026 unfolds, the gold mining sector has transformed from a traditional defensive harbor into a high-octane engine for portfolio growth. With spot gold prices surging toward the $6,300 per ounce mark, the industry’s heavyweights are witnessing a fundamental re-rating. Recent research notes from

Via MarketMinute · March 5, 2026

As of March 5, 2026, the global financial landscape is still reeling from the most significant constitutional and economic collision in decades. Following the February 20 decision by the U.S. Supreme Court to strike down President Trump’s sweeping "Liberation Day" tariffs, a vacuum of fiscal uncertainty has pulled

Via MarketMinute · March 5, 2026

NEW YORK — The silver market has long been nicknamed "gold on steroids," but the first week of March 2026 has pushed that reputation to its absolute limit. After a tumultuous start to the year that saw silver touch historic highs in January, the metal faced a brutal reckoning on Tuesday,

Via MarketMinute · March 5, 2026

The global financial landscape has been thrown into a state of high-intensity volatility following the commencement of a massive, coordinated military campaign by the United States and Israel against Iranian strategic targets. As of today, March 5, 2026, the geopolitical landscape has shifted fundamentally, sending shockwaves through commodity pits and

Via MarketMinute · March 5, 2026

The financial landscape of 2026 is witnessing a profound shift in global capital as the "Emerging Markets Breakout" transitions from a technical signal to a full-blown market regime. For the first time in over fifteen years, the MSCI Emerging Markets Index has decisively cleared long-standing resistance levels, marking what analysts

Via MarketMinute · March 4, 2026

As of today, March 4, 2026, the U.S. labor market is flashing a surprising signal of strength in the face of persistent economic headwinds. Fresh data released this morning by Automatic Data Processing, Inc. (NASDAQ: ADP) reveals that private-sector hiring picked up more than expected in February, providing a

Via MarketMinute · March 4, 2026

Shares of AXT Inc (NASDAQ:AXTI) experienced a sharp 7.95% decline on March 4, 2026, marking a significant intraday pullback for one of the year’s top-performing semiconductor stocks. Despite Wednesday's sell-off, the company remains a standout performer in the 2026 market, with its valuation still more than doubling

Via MarketMinute · March 4, 2026

On March 4, 2026, the financial markets witnessed a robust resurgence in the consumer discretionary sector, led by a significant rebound in travel and retail equities. Shares of Expedia Group (NASDAQ: EXPE) climbed 3.6%, spearheading a broader market rally that signaled renewed investor confidence in the American consumer's appetite

Via MarketMinute · March 4, 2026

NEW YORK — The "Golden Age" of private credit has met its most grueling stress test yet. As of March 4, 2026, the $1.7 trillion private lending market and its symbiotic partner, private equity, are facing a brutal reckoning. After years of rapid expansion fueled by low interest rates and

Via MarketMinute · March 4, 2026

March 4, 2026 — The global financial landscape has been fundamentally altered this week as precious metals prices hit levels once considered the realm of speculative fiction. Gold has stabilized at a staggering $5,133.40 per ounce, while silver prices recorded a violent 11% surge in just five trading days,

Via MarketMinute · March 4, 2026

As the smoke clears—literally and figuratively—from the dramatic military escalations in the Persian Gulf this week, the global financial landscape is undergoing its most violent structural shift in years. Investors, spooked by the sudden specter of a prolonged conflict in the Middle East, are aggressively rotating out of

Via MarketMinute · March 4, 2026

WASHINGTON, D.C. — As of March 4, 2026, the global financial landscape is bracing for one of the most significant architectural shifts in the history of American central banking. With Jerome Powell’s term as Chair of the Federal Reserve set to expire in May, President Donald Trump has moved

Via MarketMinute · March 4, 2026

The first quarter of 2026 has ushered in a dramatic reversal of the decade-long market hierarchy. After years of trailing in the shadow of mega-cap technology giants, small-cap stocks—the perennial underdogs of Wall Street—have surged to a commanding lead. As of March 4, 2026, the small-cap-heavy Russell 2000

Via MarketMinute · March 4, 2026

The long-standing dominance of International Business Machines Corp. (NYSE: IBM) over the world’s legacy financial infrastructure faced its most significant threat this week. Following a breakthrough announcement from the AI startup Anthropic, IBM shares tumbled more than 7% in a high-volume sell-off that has sent shockwaves through the enterprise

Via MarketMinute · March 4, 2026