As the Q2 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the aerospace industry, including Textron (NYSE:TXT) and its peers.

Aerospace companies often possess technical expertise and have made significant capital investments to produce complex products. It is an industry where innovation is important, and lately, emissions and automation are in focus, so companies that boast advances in these areas can take market share. On the other hand, demand for aerospace products can ebb and flow with economic cycles and geopolitical tensions, which can be particularly painful for companies with high fixed costs.

The 14 aerospace stocks we track reported a strong Q2. As a group, revenues beat analysts’ consensus estimates by 2.6% while next quarter’s revenue guidance was 0.8% below.

While some aerospace stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 1.7% since the latest earnings results.

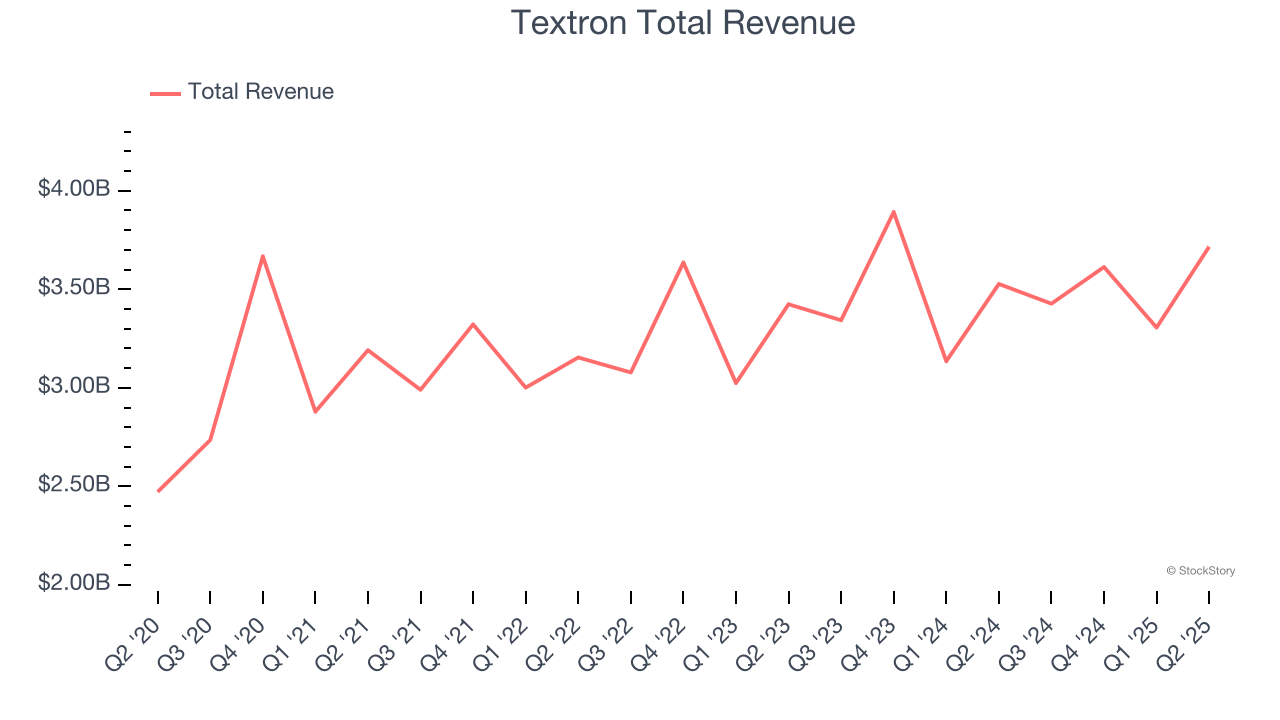

Textron (NYSE:TXT)

Listed on the NYSE in 1947, Textron (NYSE:TXT) provides products and services in the aerospace, defense, industrial, and finance sectors.

Textron reported revenues of $3.72 billion, up 5.4% year on year. This print exceeded analysts’ expectations by 2.4%. Overall, it was a very strong quarter for the company with a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ organic revenue estimates.

"In the quarter, we saw revenue growth in both our commercial aircraft and helicopter businesses, as well as in Bell's FLRAA program, now known as the MV-75," said Textron Chairman and CEO Scott C. Donnelly.

Unsurprisingly, the stock is down 7.4% since reporting and currently trades at $80.76.

Is now the time to buy Textron? Access our full analysis of the earnings results here, it’s free.

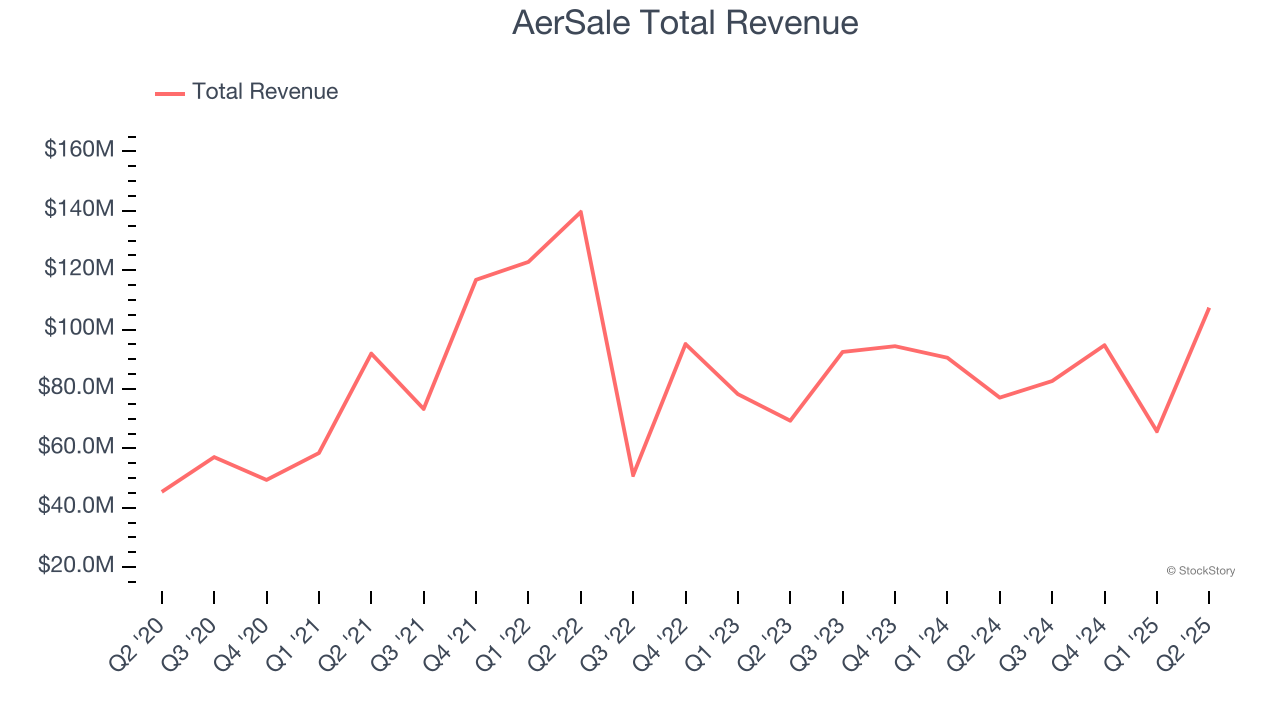

Best Q2: AerSale (NASDAQ:ASLE)

Providing a one-stop shop that integrates multiple services and product offerings, AerSale (NASDAQ:ASLE) delivers full-service support to mid-life commercial aircraft.

AerSale reported revenues of $107.4 million, up 39.3% year on year, outperforming analysts’ expectations by 24.4%. The business had an incredible quarter with a beat of analysts’ EPS and EBITDA estimates.

AerSale delivered the biggest analyst estimates beat and fastest revenue growth among its peers. The market seems happy with the results as the stock is up 44.1% since reporting. It currently trades at $8.89.

Is now the time to buy AerSale? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Astronics (NASDAQ:ATRO)

Integrating power outlets into many Boeing aircraft, Astronics (NASDAQ:ATRO) is a provider of technologies and services to the global aerospace, defense, and electronics industries.

Astronics reported revenues of $204.7 million, up 3.3% year on year, falling short of analysts’ expectations by 1.7%. It was a slower quarter as it posted a significant miss of analysts’ EBITDA estimates.

Interestingly, the stock is up 3.5% since the results and currently trades at $36.62.

Read our full analysis of Astronics’s results here.

TransDigm (NYSE:TDG)

Supplying parts for nearly all aircraft currently in service, TransDigm (NYSE:TDG) develops and manufactures components and systems for military and commercial aviation.

TransDigm reported revenues of $2.24 billion, up 9.3% year on year. This print came in 2.8% below analysts' expectations. It was a slower quarter as it also produced a miss of analysts’ organic revenue estimates and a significant miss of analysts’ EPS estimates.

TransDigm had the weakest full-year guidance update among its peers. The stock is down 13.6% since reporting and currently trades at $1,390.

Read our full, actionable report on TransDigm here, it’s free.

Boeing (NYSE:BA)

One of the companies that forms a duopoly in the commercial aircraft market, Boeing (NYSE:BA) develops, manufactures, and services commercial airplanes, defense products, and space systems.

Boeing reported revenues of $22.75 billion, up 34.9% year on year. This result beat analysts’ expectations by 5.3%. More broadly, it was a satisfactory quarter as it also logged a solid beat of analysts’ sales volume estimates but a significant miss of analysts’ adjusted operating income estimates.

The stock is down 3.5% since reporting and currently trades at $228.01.

Read our full, actionable report on Boeing here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.