Parker-Hannifin trades at $735.30 per share and has stayed right on track with the overall market, gaining 11.3% over the last six months. At the same time, the S&P 500 has returned 8.1%.

Is there a buying opportunity in Parker-Hannifin, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.

Why Is Parker-Hannifin Not Exciting?

We're swiping left on Parker-Hannifin for now. Here are three reasons why PH doesn't excite us and a stock we'd rather own.

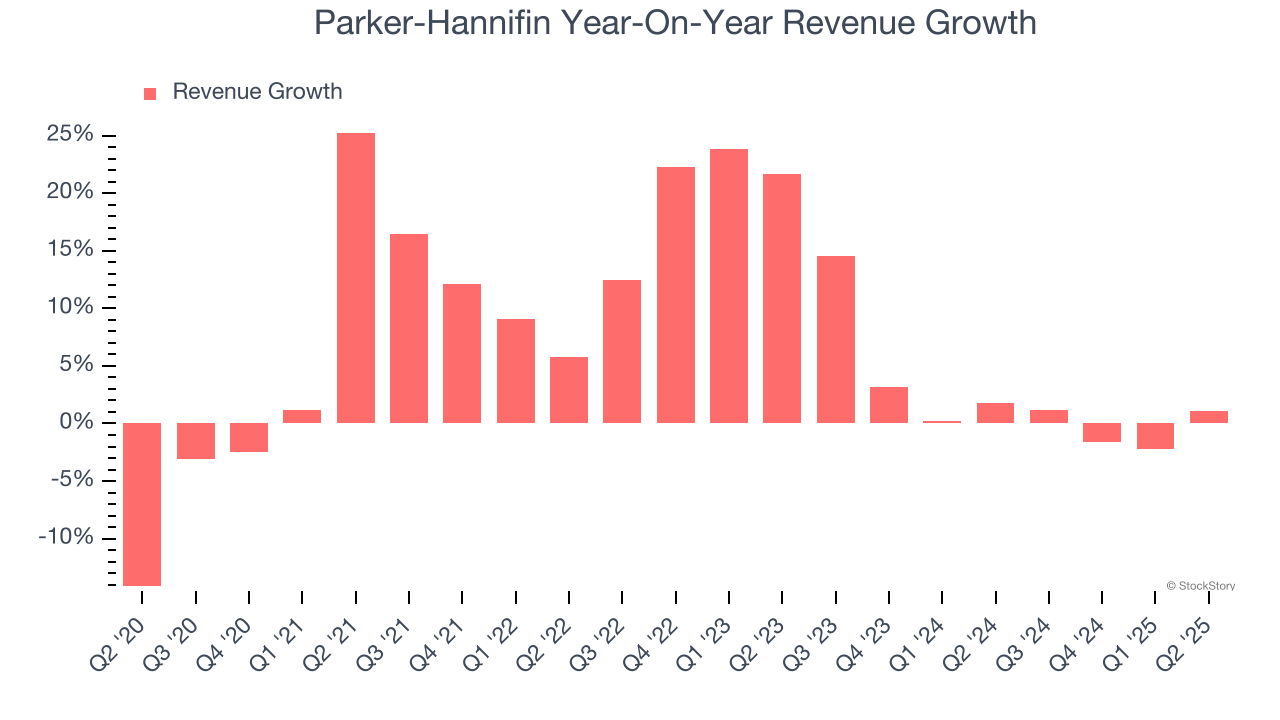

1. Lackluster Revenue Growth

We at StockStory place the most emphasis on long-term growth, but within industrials, a stretched historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Parker-Hannifin’s recent performance shows its demand has slowed as its annualized revenue growth of 2% over the last two years was below its five-year trend.

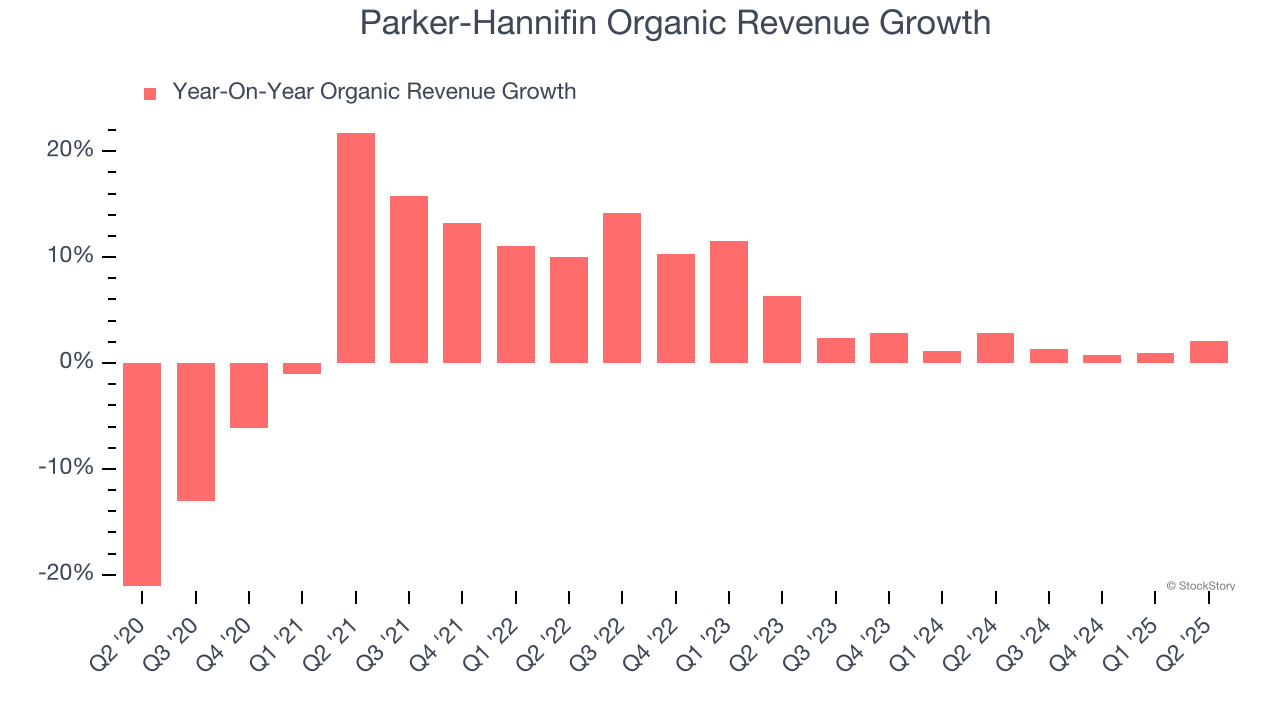

2. Slow Organic Growth Suggests Waning Demand In Core Business

In addition to reported revenue, organic revenue is a useful data point for analyzing Gas and Liquid Handling companies. This metric gives visibility into Parker-Hannifin’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Parker-Hannifin’s organic revenue averaged 1.8% year-on-year growth. This performance was underwhelming and suggests it may need to improve its products, pricing, or go-to-market strategy, which can add an extra layer of complexity to its operations.

3. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Parker-Hannifin’s revenue to rise by 3.9%. Although this projection implies its newer products and services will catalyze better top-line performance, it is still below average for the sector.

Final Judgment

Parker-Hannifin’s business quality ultimately falls short of our standards. That said, the stock currently trades at 25.8× forward P/E (or $735.30 per share). While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're fairly confident there are better stocks to buy right now. We’d suggest looking at a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Would Buy Instead of Parker-Hannifin

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.