Since February 2025, Sonos has been in a holding pattern, floating around $13.60. The stock also fell short of the S&P 500’s 8.1% gain during that period.

Is there a buying opportunity in Sonos, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.

Why Do We Think Sonos Will Underperform?

We don't have much confidence in Sonos. Here are three reasons why SONO doesn't excite us and a stock we'd rather own.

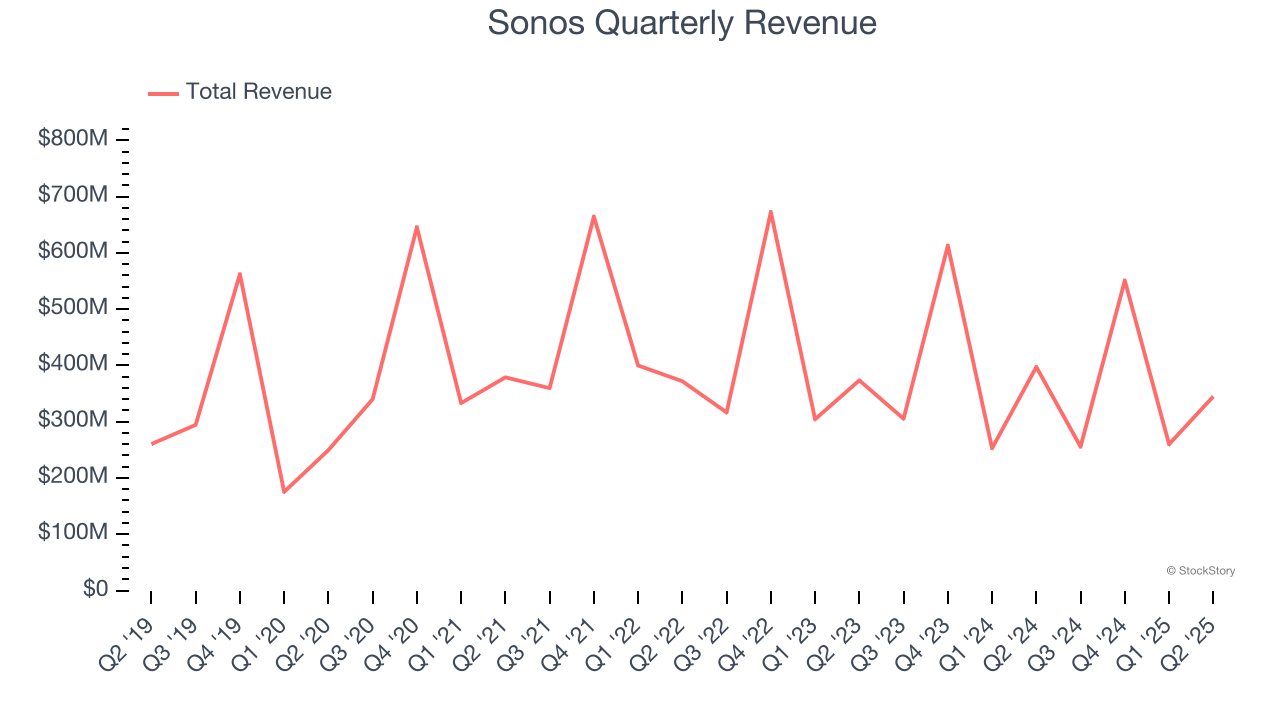

1. Long-Term Revenue Growth Disappoints

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Sonos grew its sales at a weak 2% compounded annual growth rate. This was below our standards.

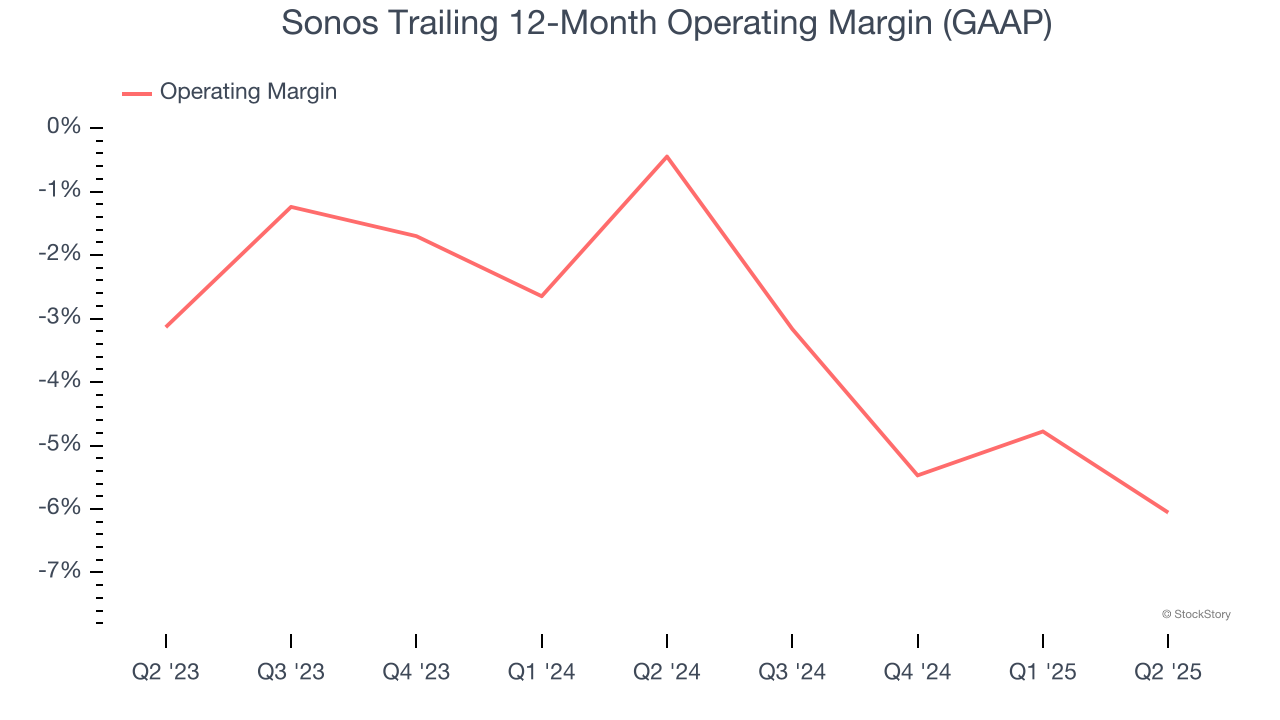

2. Operating Losses Sound the Alarms

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Sonos’s operating margin has been trending down over the last 12 months and averaged negative 3.1% over the last two years. Unprofitable consumer discretionary companies with falling margins deserve extra scrutiny because they’re spending loads of money to stay relevant, an unsustainable practice.

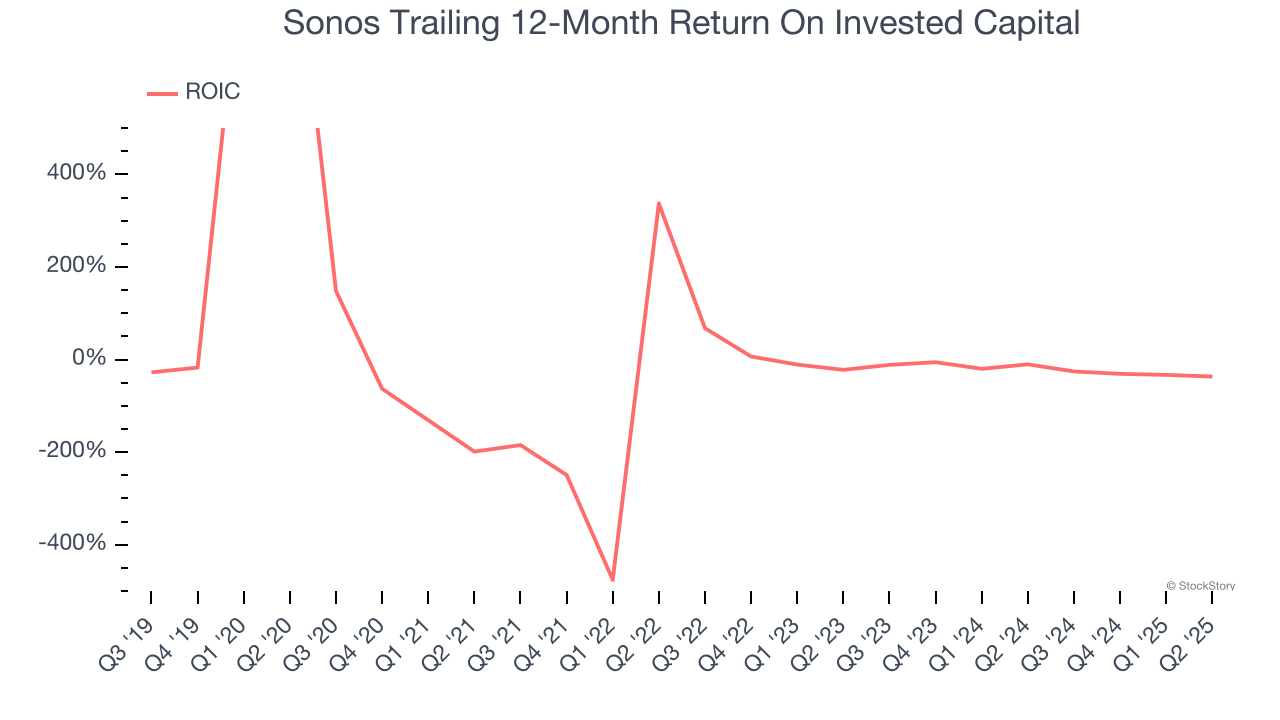

3. Previous Growth Initiatives Have Lost Money

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Sonos’s five-year average ROIC was negative 23.1%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer discretionary sector.

Final Judgment

Sonos doesn’t pass our quality test. With its shares trailing the market in recent months, the stock trades at 21.9× forward P/E (or $13.60 per share). This valuation tells us a lot of optimism is priced in - we think other companies feature superior fundamentals at the moment. We’d recommend looking at the most entrenched endpoint security platform on the market.

Stocks We Would Buy Instead of Sonos

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.