Earnings results often indicate what direction a company will take in the months ahead. With Q2 behind us, let’s have a look at First Merchants (NASDAQ:FRME) and its peers.

Regional banks, financial institutions operating within specific geographic areas, serve as intermediaries between local depositors and borrowers. They benefit from rising interest rates that improve net interest margins (the difference between loan yields and deposit costs), digital transformation reducing operational expenses, and local economic growth driving loan demand. However, these banks face headwinds from fintech competition, deposit outflows to higher-yielding alternatives, credit deterioration (increasing loan defaults) during economic slowdowns, and regulatory compliance costs. Recent concerns about regional bank stability following high-profile failures and significant commercial real estate exposure present additional challenges.

The 98 regional banks stocks we track reported a satisfactory Q2. As a group, revenues were in line with analysts’ consensus estimates.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 5% since the latest earnings results.

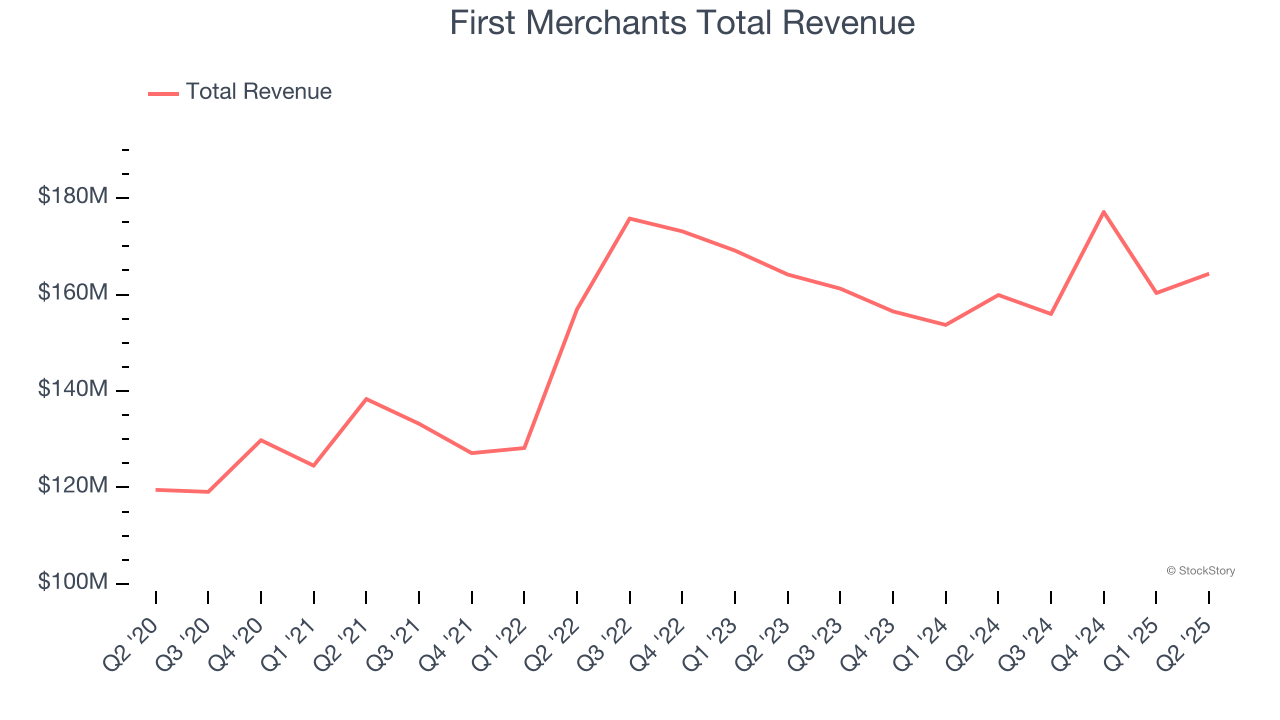

First Merchants (NASDAQ:FRME)

Dating back to 1893 when it first opened its doors in Indiana, First Merchants (NASDAQ:FRME) is a Midwest regional bank providing commercial, consumer, and wealth management services through branches in Indiana, Ohio, Michigan, and Illinois.

First Merchants reported revenues of $164.3 million, up 2.8% year on year. This print fell short of analysts’ expectations by 0.9%. Overall, it was a slower quarter for the company with a significant miss of analysts’ net interest income and tangible book value per share estimates.

"Our strong balance sheet and earnings growth in the first half of the year underscore the strength and resilience of our business model," said Mark Hardwick, Chief Executive Officer of First Merchants Bank.

Unsurprisingly, the stock is down 9.1% since reporting and currently trades at $37.56.

Read our full report on First Merchants here, it’s free.

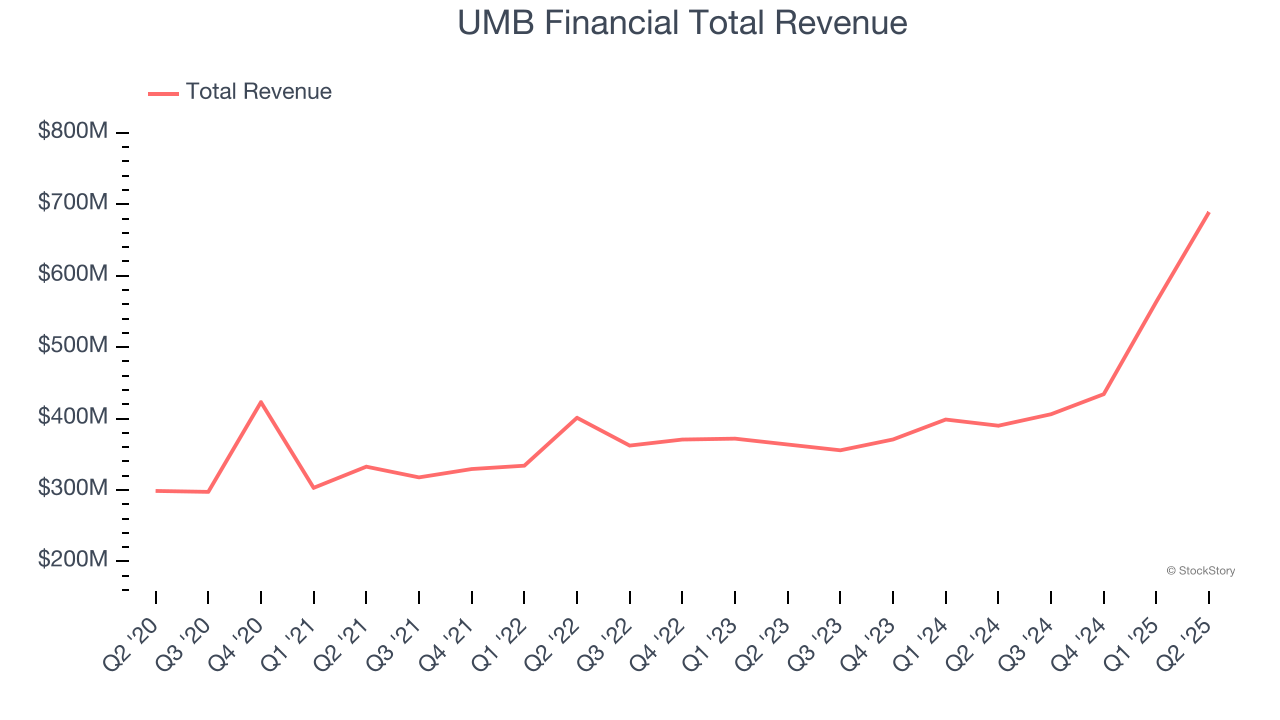

Best Q2: UMB Financial (NASDAQ:UMBF)

With roots dating back to 1913 and a name derived from "United Missouri Bank," UMB Financial (NASDAQ:UMBF) is a financial holding company that provides banking, asset management, and fund services to commercial, institutional, and individual customers.

UMB Financial reported revenues of $689.2 million, up 76.7% year on year, outperforming analysts’ expectations by 8.6%. The business had a stunning quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ tangible book value per share estimates.

However, the results were likely priced into the stock as it’s traded sideways since reporting. Shares currently sit at $110.18.

Is now the time to buy UMB Financial? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Coastal Financial (NASDAQ:CCB)

Pioneering the intersection of traditional banking and financial technology in the Pacific Northwest, Coastal Financial (NASDAQ:CCB) operates as a bank holding company that provides traditional banking services and Banking-as-a-Service (BaaS) solutions to consumers and businesses.

Coastal Financial reported revenues of $119.4 million, down 11.7% year on year, falling short of analysts’ expectations by 21.5%. It was a disappointing quarter as it posted a significant miss of analysts’ net interest income estimates and a significant miss of analysts’ EPS estimates.

As expected, the stock is down 1.4% since the results and currently trades at $100.

Read our full analysis of Coastal Financial’s results here.

Nicolet Bankshares (NYSE:NIC)

Starting as Green Bay Financial Corporation in 2000 before rebranding in 2002, Nicolet Bankshares (NYSE:NIC) is a regional bank holding company that provides commercial, agricultural, and consumer banking services primarily in Wisconsin, Michigan, and Minnesota.

Nicolet Bankshares reported revenues of $95.74 million, up 12.7% year on year. This print topped analysts’ expectations by 4.4%. It was a very strong quarter as it also put up a solid beat of analysts’ net interest income estimates and a decent beat of analysts’ EPS estimates.

The stock is flat since reporting and currently trades at $126.36.

Read our full, actionable report on Nicolet Bankshares here, it’s free.

East West Bank (NASDAQ:EWBC)

As the largest independent bank in the U.S. focused on bridging financial services between America and Asia, East West Bancorp (NASDAQ:EWBC) operates a commercial bank that provides personal and business banking services with a unique focus on facilitating U.S.-Asia cross-border transactions.

East West Bank reported revenues of $703.3 million, up 10.2% year on year. This result met analysts’ expectations. Zooming out, it was a mixed quarter as it also produced a narrow beat of analysts’ tangible book value per share estimates but EPS in line with analysts’ estimates.

The stock is down 9.1% since reporting and currently trades at $99.11.

Read our full, actionable report on East West Bank here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.