Since January 2025, MetLife has been in a holding pattern, posting a small loss of 2.5% while floating around $78.24. The stock also fell short of the S&P 500’s 7.5% gain during that period.

Is now the time to buy MetLife, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Do We Think MetLife Will Underperform?

We're sitting this one out for now. Here are three reasons why MET doesn't excite us and a stock we'd rather own.

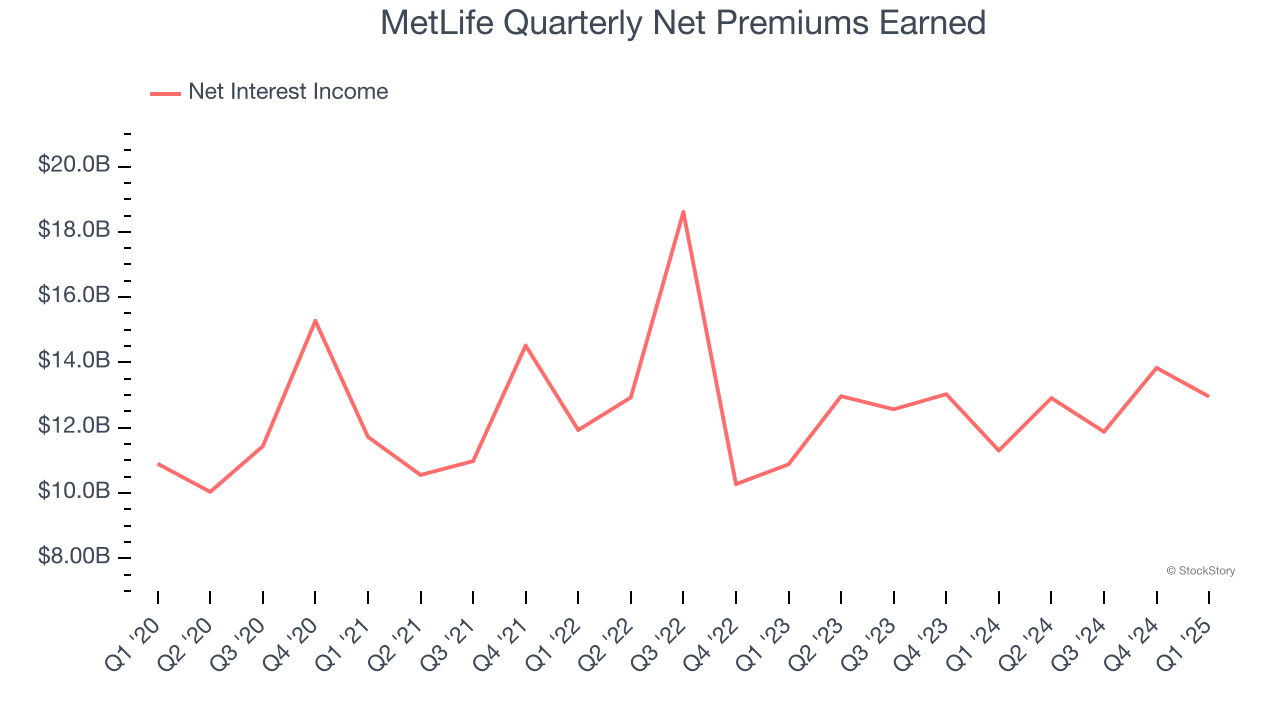

1. Declining Net Premiums Earned Reflects Weakness

Net premiums earned commands greater market attention due to its reliability and consistency, whereas investment and fee income are often seen as more volatile revenue streams that fluctuate with market conditions.

MetLife’s net premiums earned has declined by 1.1% annually over the last two years, much worse than the broader insurance industry. This shows that policy underwriting underperformed its other business lines.

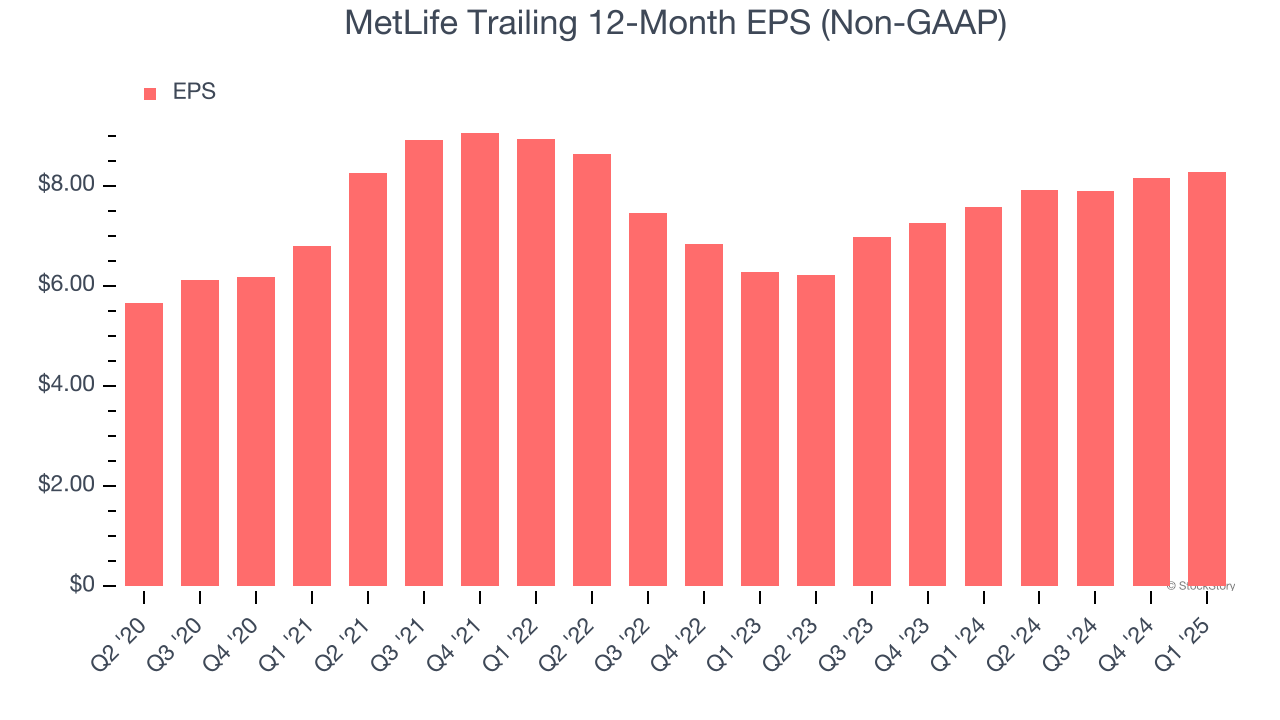

2. EPS Barely Growing

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

MetLife’s EPS grew at a weak 4.4% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 2.2% annualized revenue growth and tells us the company became more profitable on a per-share basis as it expanded.

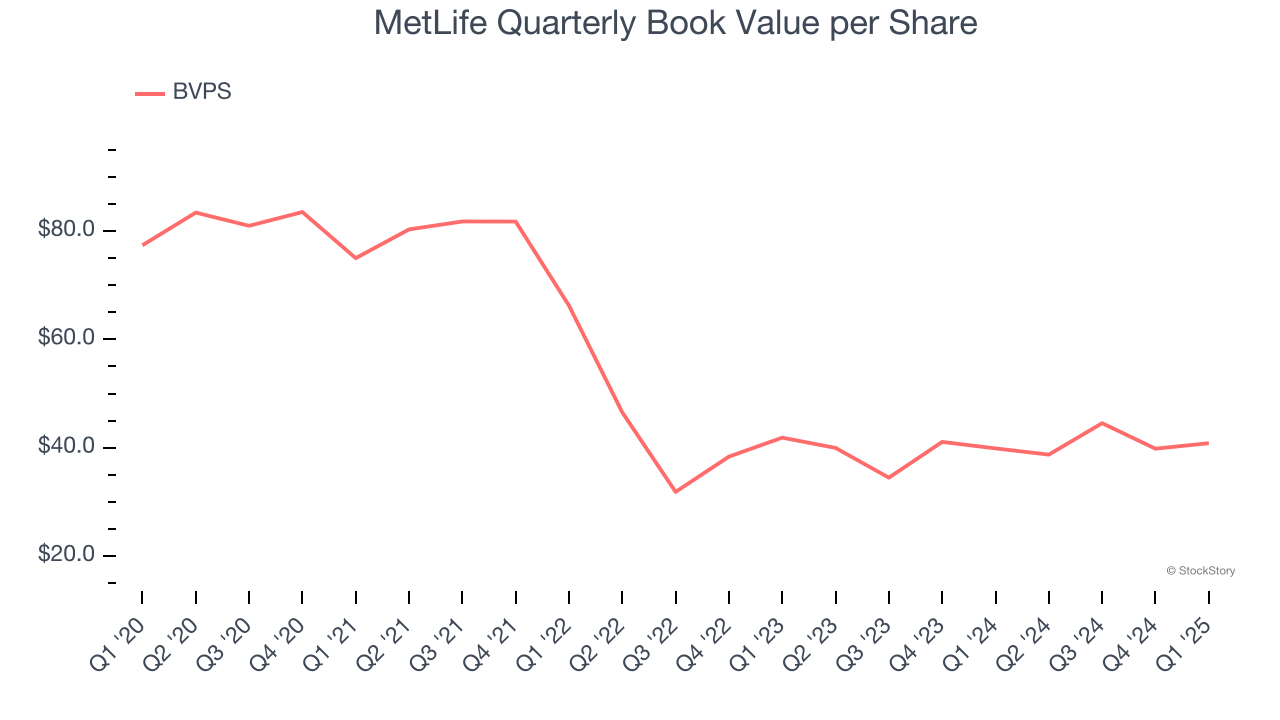

3. Declining BVPS Reflects Erosion of Asset Value

Book value per share (BVPS) serves as a key indicator of an insurer’s financial stability, reflecting a company’s ability to maintain adequate capital levels and meet its long-term obligations to policyholders.

To the detriment of investors, MetLife’s BVPS declined at a 1.2% annual clip over the last two years.

Final Judgment

We cheer for all companies serving everyday consumers, but in the case of MetLife, we’ll be cheering from the sidelines. With its shares underperforming the market lately, the stock trades at 2× forward P/B (or $78.24 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think there are better stocks to buy right now. We’d recommend looking at one of our top software and edge computing picks.

Stocks We Like More Than MetLife

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.