Wrapping up Q1 earnings, we look at the numbers and key takeaways for the drug development inputs & services stocks, including Charles River Laboratories (NYSE:CRL) and its peers.

Companies specializing in drug development inputs and services play a crucial role in the pharmaceutical and biotechnology value chain. Essential support for drug discovery, preclinical testing, and manufacturing means stable demand, as pharmaceutical companies often outsource non-core functions with medium to long-term contracts. However, the business model faces high capital requirements, customer concentration, and vulnerability to shifts in biopharma R&D budgets or regulatory frameworks. Looking ahead, the industry will likely enjoy tailwinds such as increasing investment in biologics, cell and gene therapies, and advancements in precision medicine, which drive demand for sophisticated tools and services. There is a growing trend of outsourcing in drug development for nimbleness and cost efficiency, which benefits the industry. On the flip side, potential headwinds include pricing pressures as efforts to contain healthcare costs are always top of mind. An evolving regulatory backdrop could also slow innovation or client activity.

The 8 drug development inputs & services stocks we track reported a very strong Q1. As a group, revenues beat analysts’ consensus estimates by 4%.

In light of this news, share prices of the companies have held steady as they are up 2% on average since the latest earnings results.

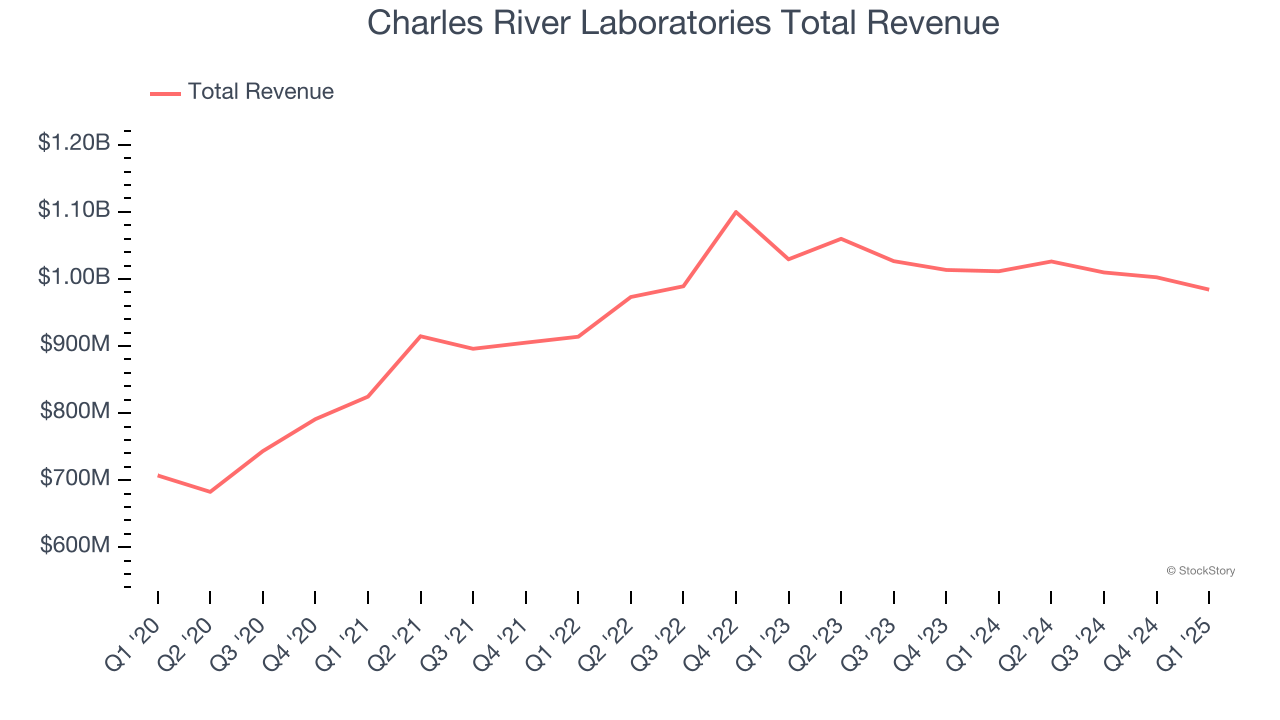

Charles River Laboratories (NYSE:CRL)

Named after the Massachusetts river where it was founded in 1947, Charles River Laboratories (NYSE:CRL) provides non-clinical drug development services, research models, and manufacturing support to pharmaceutical and biotechnology companies.

Charles River Laboratories reported revenues of $984.2 million, down 2.7% year on year. This print exceeded analysts’ expectations by 4.6%. Overall, it was an exceptional quarter for the company with a solid beat of analysts’ organic revenue estimates and an impressive beat of analysts’ full-year EPS guidance estimates.

James C. Foster, Chair, President and Chief Executive Officer, said, “The first quarter demonstrated continued signs of demand stabilization, highlighted by a notable improvement in DSA booking activity to the highest level in two years. This positive development was tempered by the general undertone of uncertainty in the broader market environment, which has led us to a balanced yet cautious view of the remainder of the year. Taking these factors into account, we are modestly increasing our financial guidance for 2025.”

Charles River Laboratories delivered the slowest revenue growth of the whole group. Interestingly, the stock is up 22.6% since reporting and currently trades at $141.38.

Is now the time to buy Charles River Laboratories? Access our full analysis of the earnings results here, it’s free.

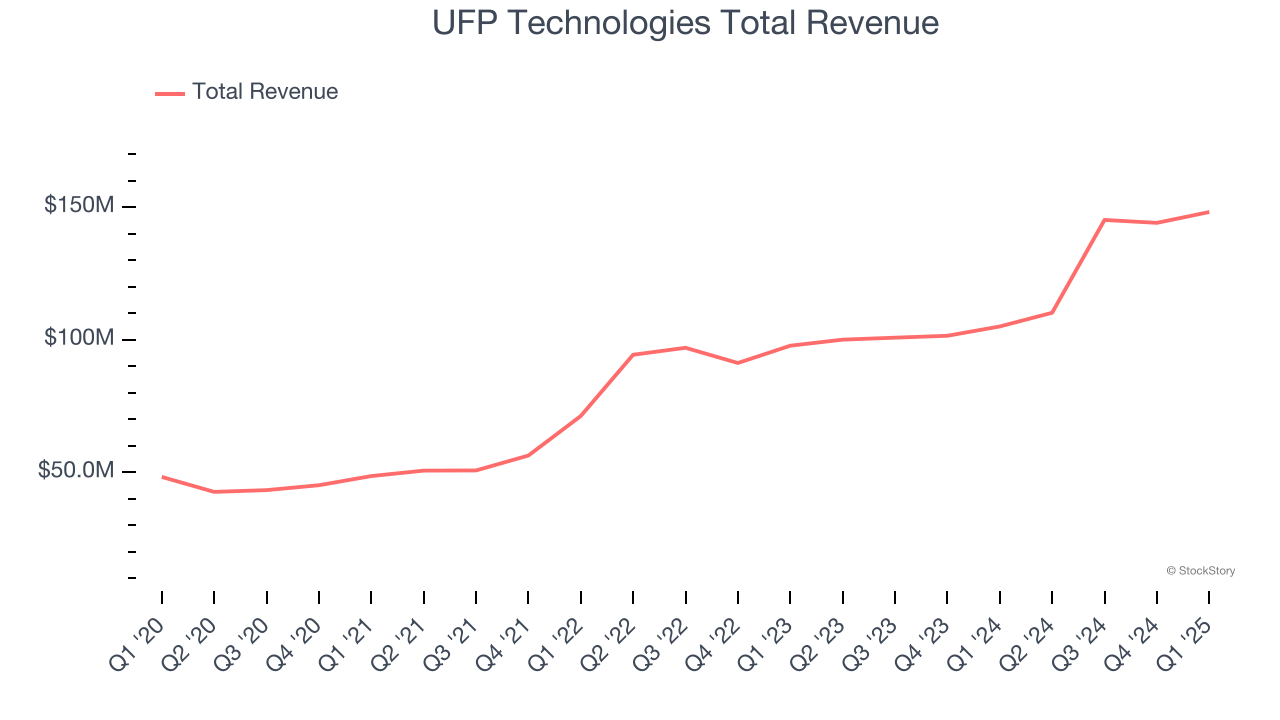

Best Q1: UFP Technologies (NASDAQ:UFPT)

With expertise dating back to 1963 in specialized materials and precision manufacturing, UFP Technologies (NASDAQ:UFPT) designs and manufactures custom solutions for medical devices, sterile packaging, and other highly engineered products for healthcare and industrial applications.

UFP Technologies reported revenues of $148.1 million, up 41.1% year on year, outperforming analysts’ expectations by 5.9%. The business had an incredible quarter with a solid beat of analysts’ EPS estimates.

UFP Technologies achieved the fastest revenue growth among its peers. The market seems happy with the results as the stock is up 22.7% since reporting. It currently trades at $241.89.

Is now the time to buy UFP Technologies? Access our full analysis of the earnings results here, it’s free.

Azenta (NASDAQ:AZTA)

Serving as the guardian of some of medicine's most valuable materials, Azenta (NASDAQ:AZTA) provides biological sample management, storage, and genomic services that help pharmaceutical and biotechnology companies preserve and analyze critical research materials.

Azenta reported revenues of $143.4 million, up 5.2% year on year, exceeding analysts’ expectations by 2%. Still, it was a slower quarter as it posted a significant miss of analysts’ EPS estimates.

Interestingly, the stock is up 6.7% since the results and currently trades at $27.12.

Read our full analysis of Azenta’s results here.

Fortrea (NASDAQ:FTRE)

Spun off from Labcorp in 2023 to focus exclusively on clinical research services, Fortrea (NASDAQ:FTRE) is a contract research organization that helps pharmaceutical, biotech, and medical device companies develop and bring their products to market through clinical trials and support services.

Fortrea reported revenues of $651.3 million, down 1.6% year on year. This print topped analysts’ expectations by 7.1%. Overall, it was an exceptional quarter as it also produced a solid beat of analysts’ EPS estimates and full-year EBITDA guidance beating analysts’ expectations.

Fortrea delivered the biggest analyst estimates beat but had the weakest full-year guidance update among its peers. The stock is down 27.4% since reporting and currently trades at $4.47.

Read our full, actionable report on Fortrea here, it’s free.

West Pharmaceutical Services (NYSE:WST)

Founded in 1923 and serving as a critical link in the pharmaceutical supply chain, West Pharmaceutical Services (NYSE:WST) manufactures specialized packaging, containment systems, and delivery devices for injectable drugs and healthcare products.

West Pharmaceutical Services reported revenues of $698 million, flat year on year. This number surpassed analysts’ expectations by 2%. It was a very strong quarter as it also logged an impressive beat of analysts’ EPS estimates and full-year revenue guidance beating analysts’ expectations.

The stock is flat since reporting and currently trades at $217.97.

Read our full, actionable report on West Pharmaceutical Services here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.