![]()

Looking back on renewable energy stocks’ Q4 earnings, we examine this quarter’s best and worst performers, including Nextracker (NASDAQ:NXT) and its peers.

Renewable energy companies are buoyed by the secular trend of green energy that is upending traditional power generation. Those who innovate and evolve with this dynamic market can win share while those who continue to rely on legacy technologies can see diminishing demand, which includes headwinds from increasing regulation against “dirty” energy. Additionally, these companies are at the whim of economic cycles, as interest rates can impact the willingness to invest in renewable energy projects.

The 17 renewable energy stocks we track reported a mixed Q4. As a group, revenues missed analysts’ consensus estimates by 4.6% while next quarter’s revenue guidance was 0.6% above.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 22.5% since the latest earnings results.

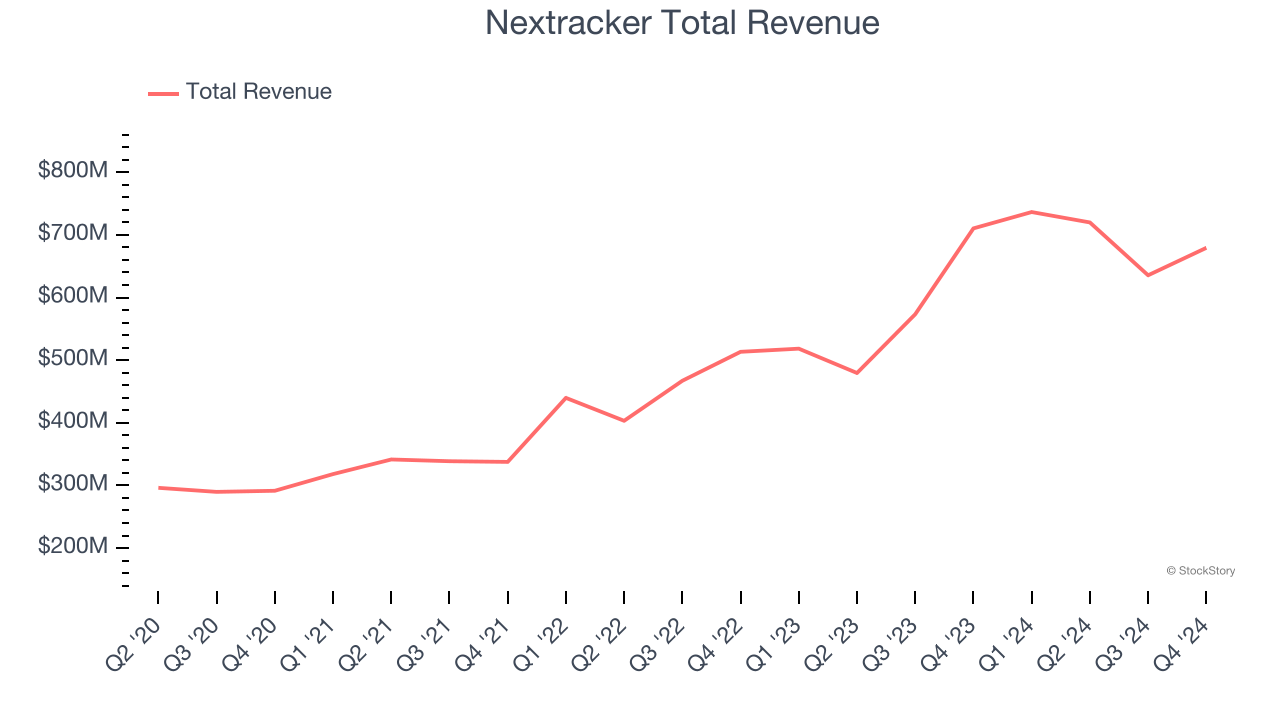

Nextracker (NASDAQ:NXT)

With its technology playing a key role in the massive 1.2 gigawatt Noor Abu Dabhi solar farm project, Nextracker (NASDAQ:NXT) is a provider of solar tracker systems that help solar panels follow the sun.

Nextracker reported revenues of $679.4 million, down 4.4% year on year. This print exceeded analysts’ expectations by 3.6%. Overall, it was a very strong quarter for the company with a solid beat of analysts’ adjusted operating income estimates.

“We’re very pleased with the company’s execution, delivering record revenue and profit year-to-date driven by strong demand,” said Dan Shugar, founder and CEO of Nextracker.

The stock is down 3.8% since reporting and currently trades at $38.11.

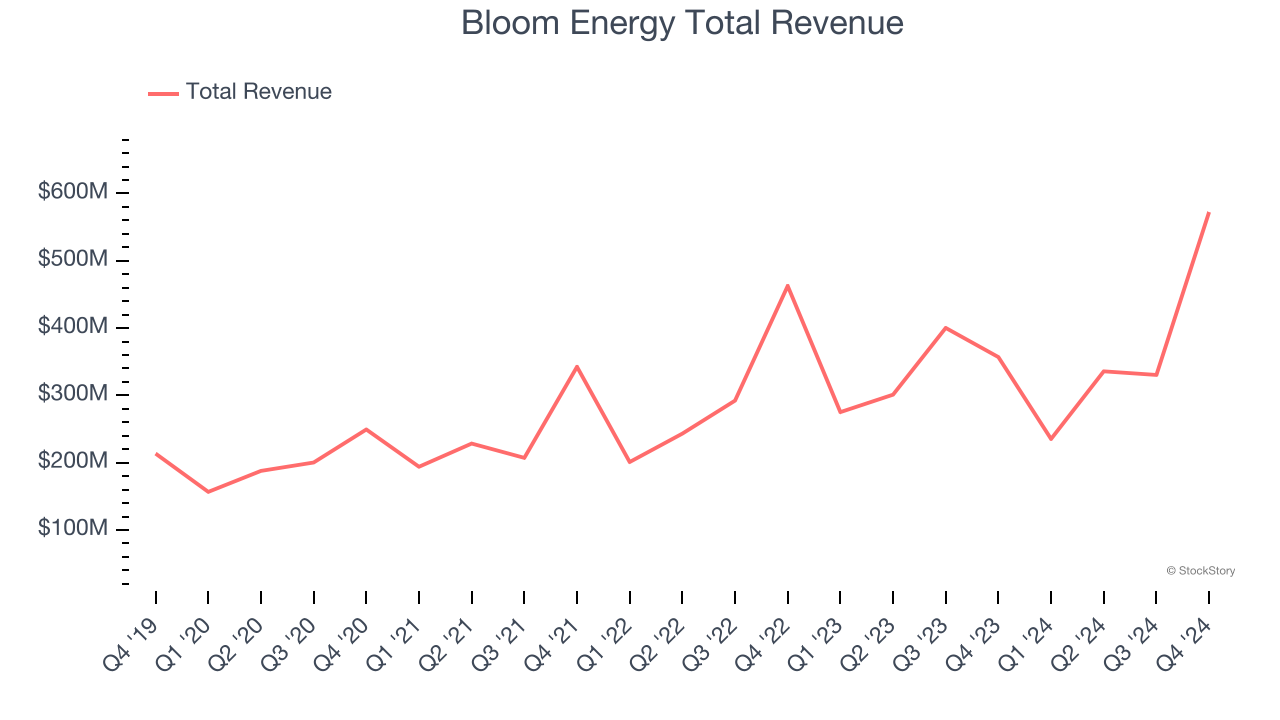

Best Q4: Bloom Energy (NYSE:BE)

Working in stealth mode for eight years, Bloom Energy (NYSE:BE) designs, manufactures, and markets solid oxide fuel cell systems for on-site power generation.

Bloom Energy reported revenues of $572.4 million, up 60.4% year on year, outperforming analysts’ expectations by 12.8%. The business had an incredible quarter with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

Bloom Energy achieved the biggest analyst estimates beat, fastest revenue growth, and highest full-year guidance raise among its peers. The stock is down 24.6% since reporting. It currently trades at $17.34.

Is now the time to buy Bloom Energy? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: TPI Composites (NASDAQ:TPIC)

Founded in 1968, TPI Composites (NASDAQ:TPIC) manufactures composite wind turbine blades and provides related precision molding and assembly systems.

TPI Composites reported revenues of $346.5 million, up 16.7% year on year, falling short of analysts’ expectations by 5%. It was a disappointing quarter as it posted full-year revenue guidance missing analysts’ expectations.

As expected, the stock is down 43.3% since the results and currently trades at $0.82.

Read our full analysis of TPI Composites’s results here.

EnerSys (NYSE:ENS)

Supplying batteries that power equipment as big as mining rigs, EnerSys (NYSE:ENS) manufactures various kinds of batteries for a range of industries.

EnerSys reported revenues of $906.2 million, up 5.2% year on year. This result came in 2.8% below analysts' expectations. More broadly, it was a mixed quarter as it also recorded EPS guidance for next quarter exceeding analysts’ expectations but a significant miss of analysts’ sales volume estimates.

The stock is down 11.6% since reporting and currently trades at $83.76.

Read our full, actionable report on EnerSys here, it’s free.

Fluence Energy (NASDAQ:FLNC)

Pioneering the use of lithium-ion batteries for grid storage, Fluence (NASDAQ:FLNC) helps store renewable energy sources with battery systems.

Fluence Energy reported revenues of $186.8 million, down 48.7% year on year. This print missed analysts’ expectations by 50.5%. Overall, it was a disappointing quarter as it also logged full-year revenue guidance missing analysts’ expectations.

Fluence Energy had the weakest performance against analyst estimates, slowest revenue growth, and weakest full-year guidance update among its peers. The stock is down 67.5% since reporting and currently trades at $4.26.

Read our full, actionable report on Fluence Energy here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.