Shareholders of HubSpot would probably like to forget the past six months even happened. The stock dropped 37.5% and now trades at $375.30. This may have investors wondering how to approach the situation.

Given the weaker price action, is this a buying opportunity for HUBS? Find out in our full research report, it’s free for active Edge members.

Why Does HUBS Stock Spark Debate?

Born from the idea that traditional interruptive marketing was becoming less effective, HubSpot (NYSE:HUBS) provides an integrated platform that helps businesses attract, engage, and manage customer relationships through marketing, sales, service, and content management tools.

Two Positive Attributes:

1. Billings Surge, Boosting Cash On Hand

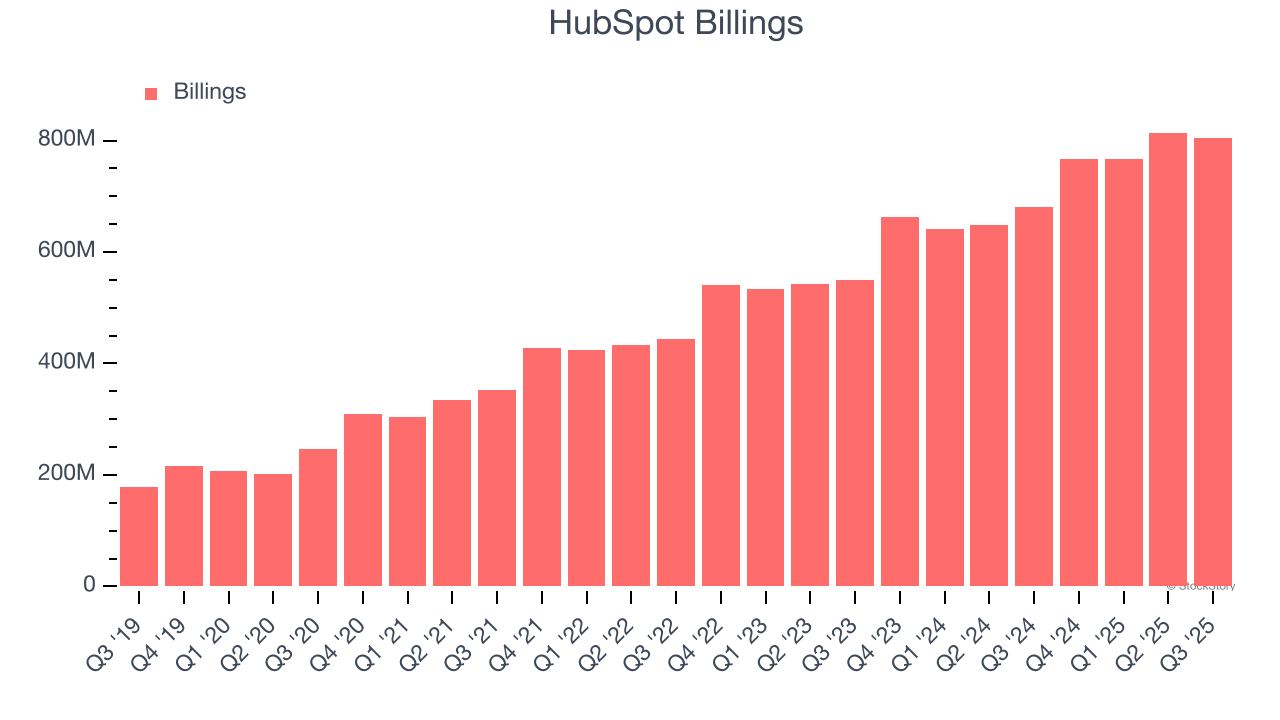

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

HubSpot’s billings punched in at $804 million in Q3, and over the last four quarters, its year-on-year growth averaged 19.8%. This performance was impressive, indicating robust customer demand. The high level of cash collected from customers also enhances liquidity and provides a solid foundation for future investments and growth.

2. Elite Gross Margin Powers Best-In-Class Business Model

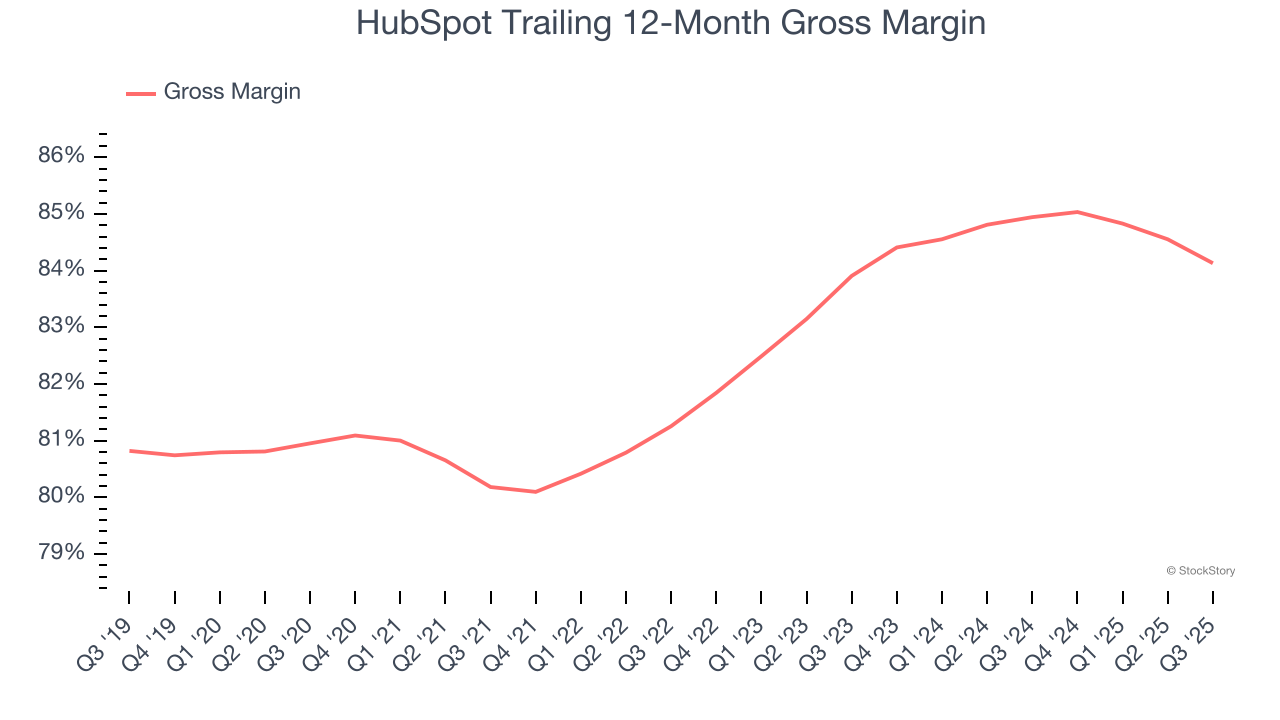

What makes the software-as-a-service model so attractive is that once the software is developed, it usually doesn’t cost much to provide it as an ongoing service. These minimal costs can include servers, licenses, and certain personnel.

HubSpot’s gross margin is one of the highest in the software sector, an output of its asset-lite business model and strong pricing power. It also enables the company to fund large investments in new products and sales during periods of rapid growth to achieve outsized profits at scale. As you can see below, it averaged an elite 84.1% gross margin over the last year. That means HubSpot only paid its providers $15.87 for every $100 in revenue.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. HubSpot has seen gross margins improve by 0.2 percentage points over the last 2 year, which is slightly better than average for software.

One Reason to be Careful:

Operating Margin Rising, Profits Up

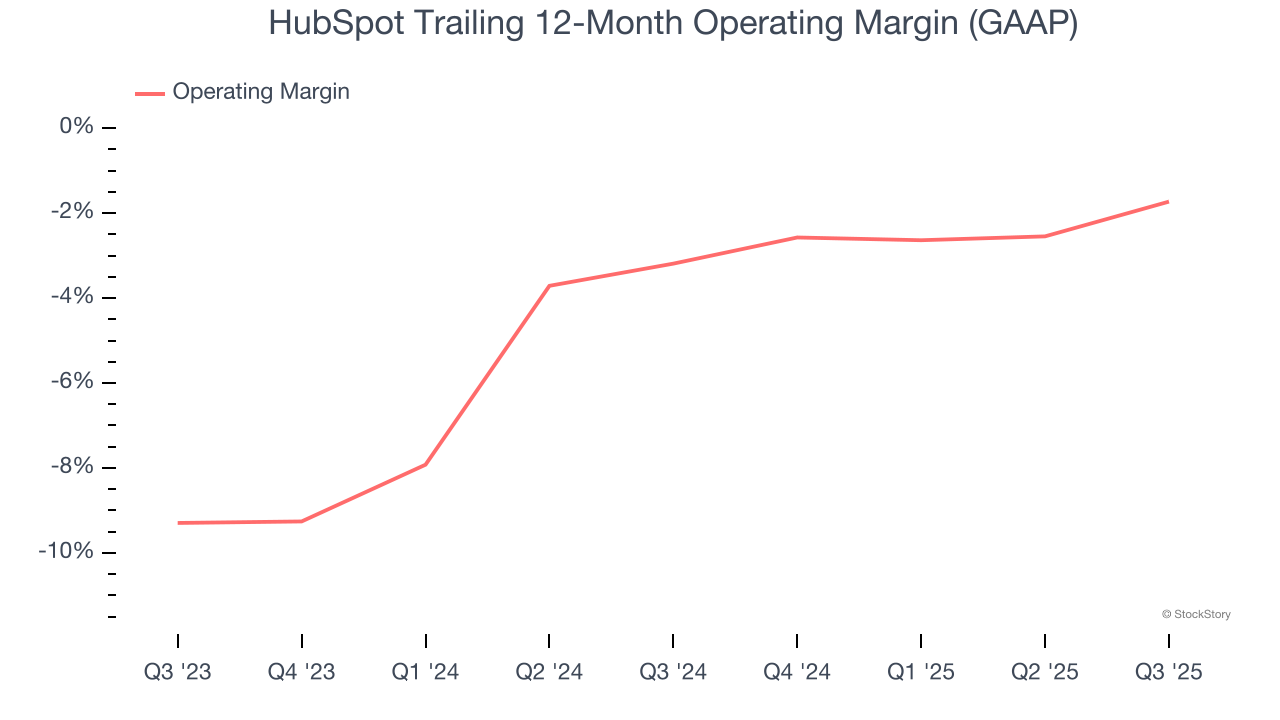

While many software businesses point investors to their adjusted profits, which exclude stock-based compensation (SBC), we prefer GAAP operating margin because SBC is a legitimate expense used to attract and retain talent. This is one of the best measures of profitability because it shows how much money a company takes home after developing, marketing, and selling its products.

Over the last two years, HubSpot’s expanding sales gave it operating leverage as its margin rose by 1.5 percentage points. Although its operating margin for the trailing 12 months was negative 1.7%, we’re confident it can one day reach sustainable profitability.

Final Judgment

HubSpot’s positive characteristics outweigh the negatives. After the recent drawdown, the stock trades at 5.6× forward price-to-sales (or $375.30 per share). Is now a good time to initiate a position? See for yourself in our comprehensive research report, it’s free for active Edge members .

Stocks We Like Even More Than HubSpot

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.