Since June 2025, Tyson Foods has been in a holding pattern, posting a small return of 2.2% while floating around $57.04. The stock also fell short of the S&P 500’s 14.1% gain during that period.

Is now the time to buy Tyson Foods, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free for active Edge members.

Why Do We Think Tyson Foods Will Underperform?

We don't have much confidence in Tyson Foods. Here are three reasons we avoid TSN and a stock we'd rather own.

1. Long-Term Revenue Growth Flatter Than a Pancake

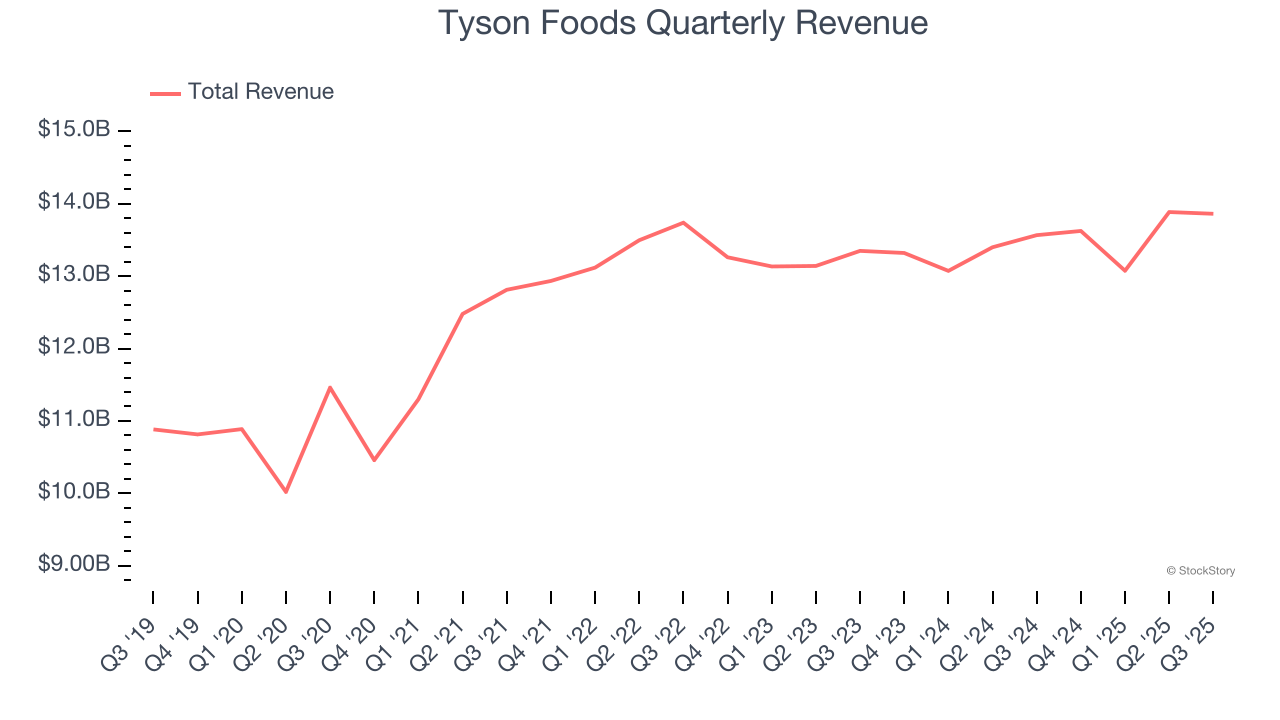

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Tyson Foods struggled to consistently increase demand as its $54.44 billion of sales for the trailing 12 months was close to its revenue three years ago. This wasn’t a great result and signals it’s a low quality business.

2. Low Gross Margin Reveals Weak Structural Profitability

At StockStory, we prefer high gross margin businesses because they indicate pricing power or differentiated products, giving the company a chance to generate higher operating profits.

Tyson Foods has bad unit economics for a consumer staples company, signaling it operates in a competitive market and lacks pricing power because its products can be substituted. As you can see below, it averaged a 7.2% gross margin over the last two years. Said differently, for every $100 in revenue, a chunky $92.82 went towards paying for raw materials, production of goods, transportation, and distribution.

3. EPS Trending Down

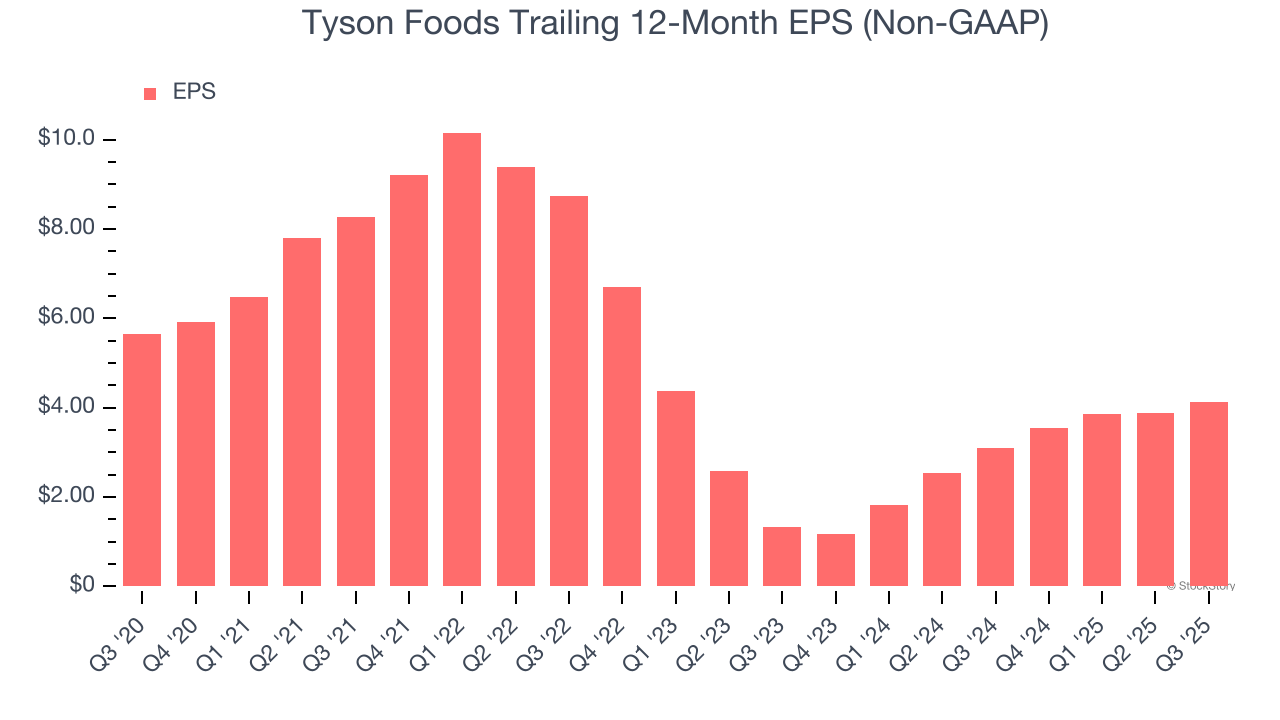

Analyzing the change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Tyson Foods, its EPS declined by 22.1% annually over the last three years while its revenue was flat. This tells us the company struggled because its fixed cost base made it difficult to adjust to choppy demand.

Final Judgment

Tyson Foods doesn’t pass our quality test. With its shares lagging the market recently, the stock trades at 15.1× forward P/E (or $57.04 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think there are better stocks to buy right now. We’d suggest looking at a safe-and-steady industrials business benefiting from an upgrade cycle.

Stocks We Would Buy Instead of Tyson Foods

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.