![]()

What a time it’s been for Nextracker. In the past six months alone, the company’s stock price has increased by a massive 50.2%, reaching $87.07 per share. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Following the strength, is NXT a buy right now? Or is the market overestimating its value? Find out in our full research report, it’s free for active Edge members.

Why Is Nextracker a Good Business?

With its technology playing a key role in the massive 1.2 gigawatt Noor Abu Dhabi solar farm project, Nextracker (NASDAQ:NXT) is a provider of solar tracker systems that help solar panels follow the sun.

1. Surging Backlog Locks In Future Sales

We can better understand Renewable Energy companies by analyzing their backlog. This metric shows the value of outstanding orders that have not yet been executed or delivered, giving visibility into Nextracker’s future revenue streams.

Nextracker’s backlog punched in at $5.06 billion in the latest quarter, and over the last two years, its year-on-year growth averaged 56.9%. This performance was fantastic and shows the company has a robust sales pipeline because it is accumulating more orders than it can fulfill. Its growth also suggests that customers are committing to Nextracker for the long term, enhancing the business’s predictability.

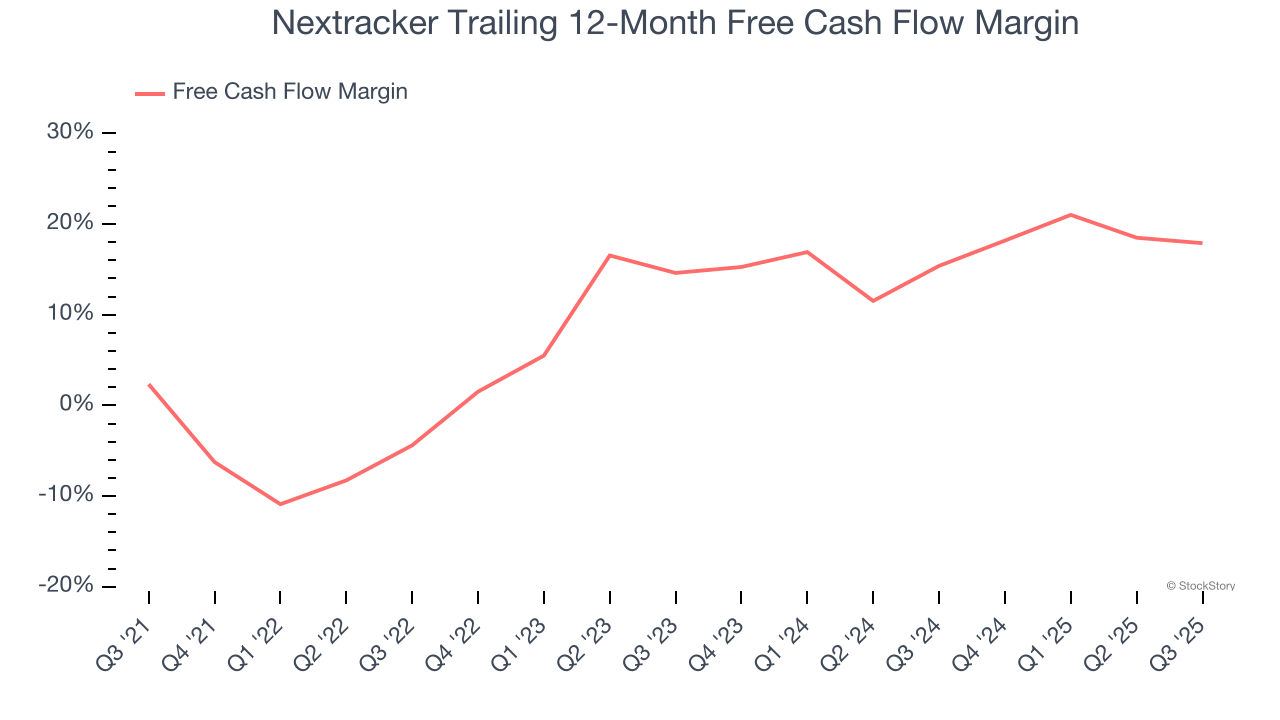

2. Increasing Free Cash Flow Margin Juices Financials

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Nextracker’s margin expanded by 15.6 percentage points over the last five years. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability. Nextracker’s free cash flow margin for the trailing 12 months was 17.9%.

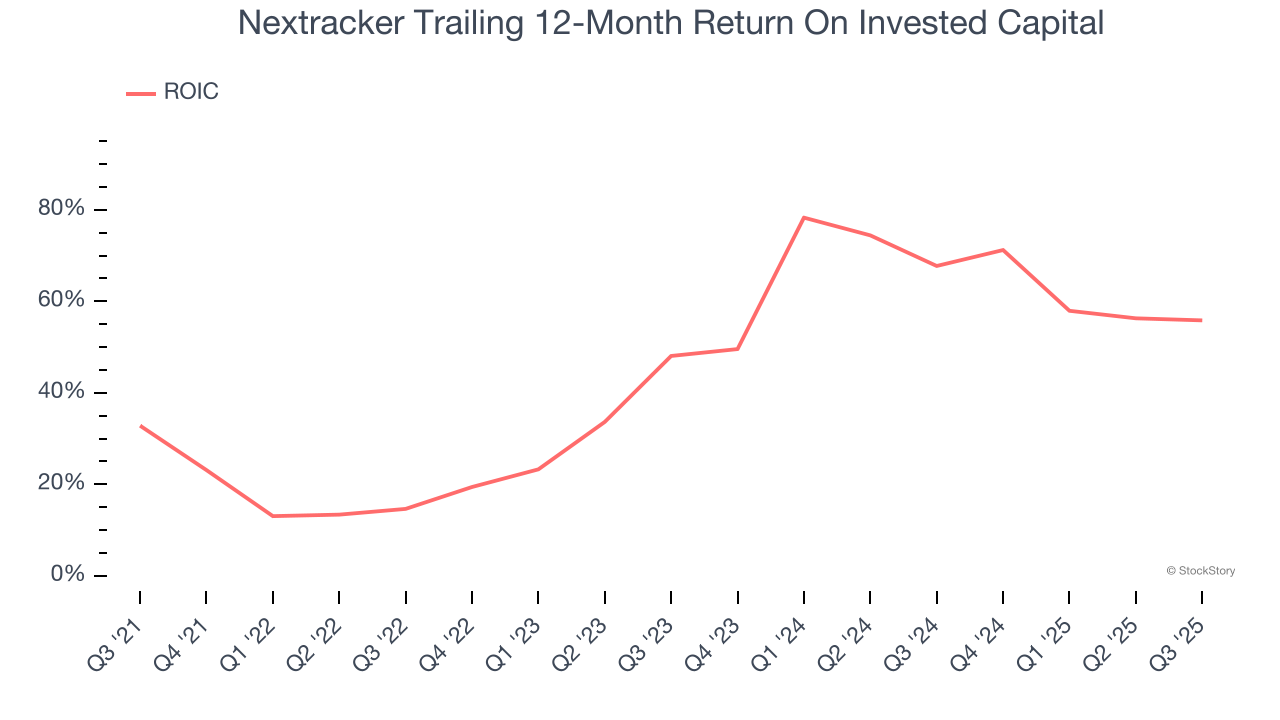

3. New Investments Bear Fruit as ROIC Jumps

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Nextracker’s ROIC has increased significantly over the last few years. This is a great sign when paired with its already strong returns. It could suggest its competitive advantage or profitable growth opportunities are expanding.

Final Judgment

These are just a few reasons why we think Nextracker is an elite industrials company, and with the recent surge, the stock trades at 20.9× forward P/E (or $87.07 per share). Is now the time to initiate a position? See for yourself in our full research report, it’s free for active Edge members.

Stocks We Like Even More Than Nextracker

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.