Root has gotten torched over the last six months - since June 2025, its stock price has dropped 43.7% to $77.42 per share. This may have investors wondering how to approach the situation.

Is now the time to buy Root, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free for active Edge members.

Why Is Root Not Exciting?

Even with the cheaper entry price, we're cautious about Root. Here are two reasons there are better opportunities than ROOT and a stock we'd rather own.

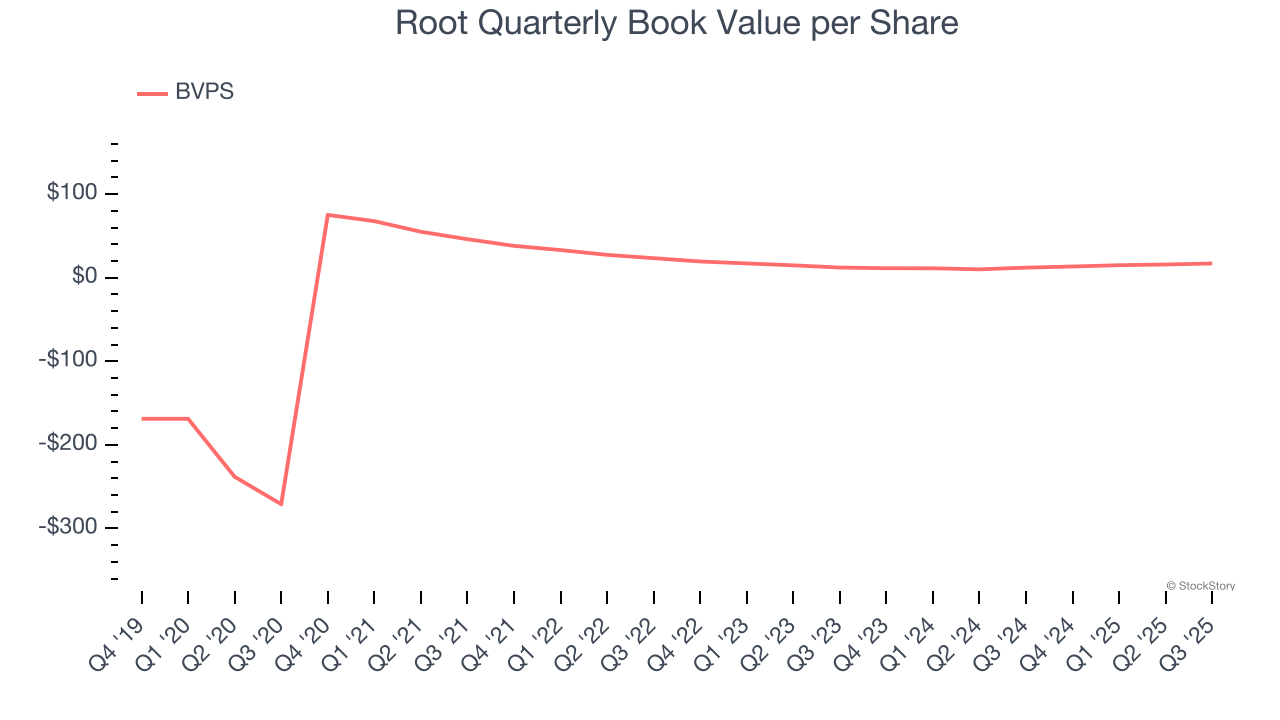

1. Growing BVPS Reflects Strong Asset Base

We consider book value per share (BVPS) a critical metric for insurance companies. BVPS represents the total net worth per share, providing insight into a company’s financial strength and ability to meet policyholder obligations.

Although Root’s BVPS declined at a 158% annual clip over the last five years. the good news is that its growth inflected positive over the past two years as BVPS grew at an impressive 18.3% annual clip (from $12.21 to $17.10 per share).

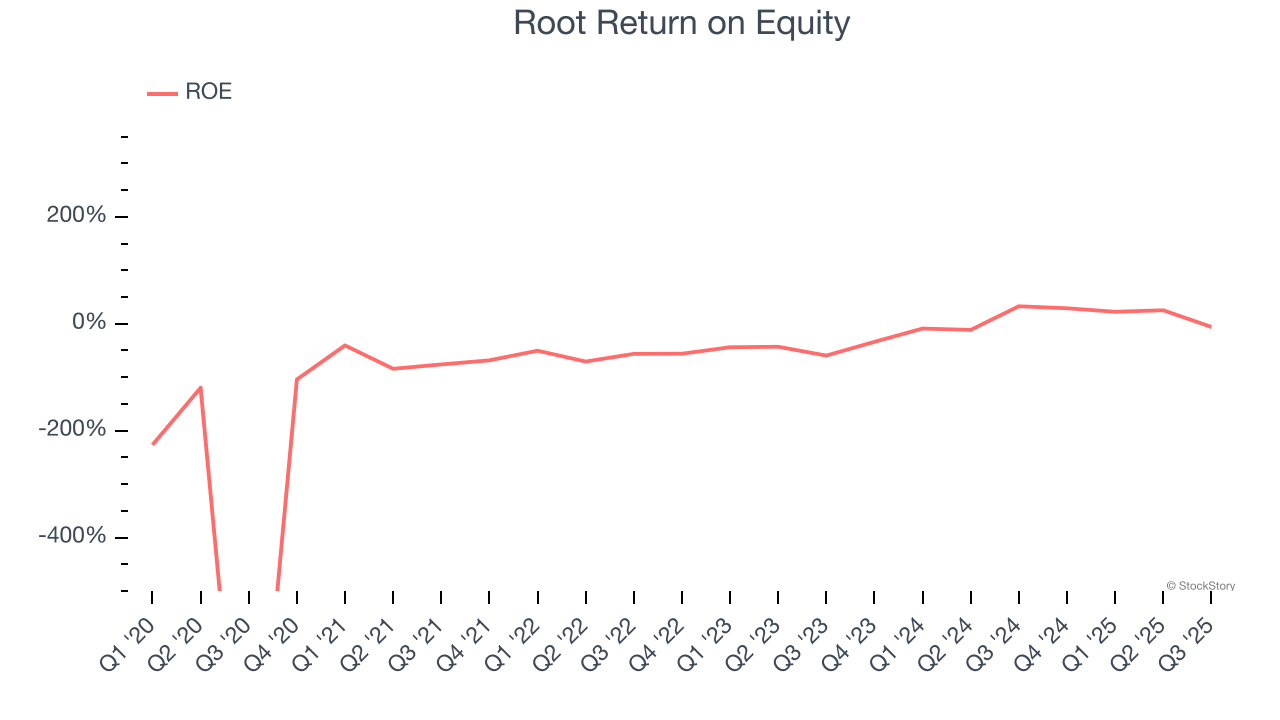

2. Previous Growth Initiatives Have Lost Money

Return on equity (ROE) serves as a comprehensive measure of an insurer's performance, showing how efficiently it converts shareholder capital into profits. Strong ROE performance typically translates to better returns for investors through a combination of earnings retention, share repurchases, and dividend distributions.

Over the last five years, Root has averaged an ROE of negative 35.2%, a bad result not only in absolute terms but also relative to the majority of insurers putting up 20%+. It also shows that Root has little to no competitive moat.

Final Judgment

Root isn’t a terrible business, but it doesn’t pass our bar. After the recent drawdown, the stock trades at 3.9× forward P/B (or $77.42 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - you can find more timely opportunities elsewhere. Let us point you toward the most dominant software business in the world.

Stocks We Would Buy Instead of Root

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.