Valued at $44.9 billion by market cap, W.W. Grainger, Inc. (GWW) is a leading U.S. industrial-supply distributor serving over 4.5 million customers across manufacturing, healthcare, government, and construction. Founded in 1927 and based in Lake Forest, Illinois, it provides a wide range of MRO products, including safety gear, tools, HVAC, and electrical supplies. Grainger operates through its High-Touch Solutions network and its digital Endless Assortment platforms, such as Zoro and MonotaRO, offering both traditional service and strong e-commerce support.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and GWW perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the industrial distribution industry. Grainger benefits from a strong brand reputation and decades-long industry presence. It has a broad product portfolio and deep supplier relationships, offering reliability and scale. Its hybrid model of branch service and powerful e-commerce platforms gives it a major competitive edge.

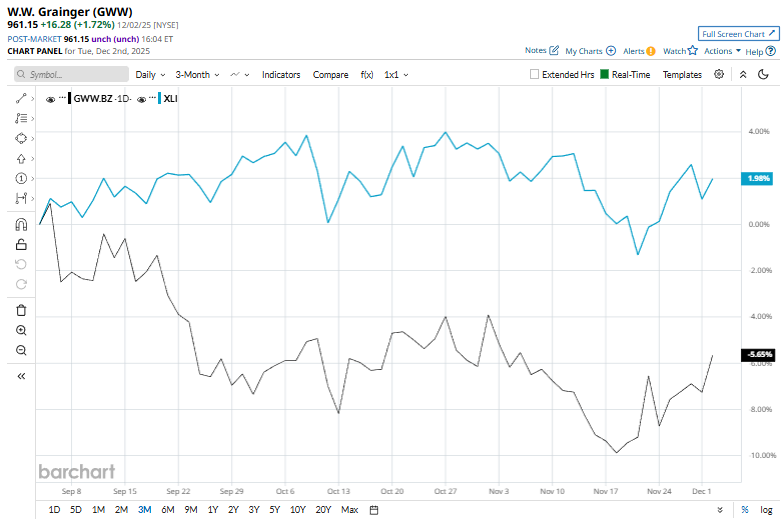

Despite its notable strength, GWW slipped 20% from its 52-week high of $1,201.68, achieved on Dec. 3 last year. Over the past three months, GWW stock declined 5.5%, underperforming the Industrial Select Sector SPDR Fund's (XLI) 1.5% gainduring the same time frame.

In the longer term, shares of GWW dipped 8.8% on a YTD basis and 19.5% over the past 52 weeks, underperforming XLI’s YTD gains of 15.9% and 6.9% returns over the last year.

Reinforcing its bearish trend, GWW has remained below both its 50-day and 200-day moving averages since mid-June.

On Oct. 31, W.W. Grainger saw its shares climb more than 2% after delivering third-quarter results, reflecting resilient demand and disciplined execution. The company posted adjusted EPS of $10.21, beating Wall Street’s expectation of $9.93, driven by solid pricing and cost management. Revenue came in at $4.7 billion, slightly ahead of the $4.6 billion consensus estimate, supported by growth across both its High-Touch Solutions and Endless Assortment segments.

Looking ahead, Grainger reaffirmed its full-year guidance, projecting adjusted EPS between $39 and $39.75 and revenue in the range of $17.8 billion to $18 billion, signaling confidence in continued operational stability despite macroeconomic headwinds.

In the competitive arena of industrial distribution, Core & Main, Inc. (CNM) has taken the lead over GWW, showing resilience with 1.4% gains over the past 52 weeks and a 3.8% downtick on a YTD basis.

Wall Street analysts are cautious on GWW’s prospects. The stock has a consensus “Hold” rating from the 19 analysts covering it, and the mean price target of $1,031.62 suggests a potential upside of 7.3% from current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Deere Got Hit by Tariffs... Again. Should You Buy the Blue-Chip Dividend Stock on the Dip?

- The Tesla Europe Sales Rout Keeps Going. Is It Time to Sell TSLA Stock?

- Dear Nuclear Energy Stocks Fans, Mark Your Calendars for December 3

- Nvidia Just Lit a Fire Under Synopsys Stock But Its Chart Is Waving Red Flags. Here’s the Only Way I’d Trade SNPS Here.