Valued at a market cap of $25.1 billion, Constellation Brands, Inc. (STZ) is a major U.S.-based beverage-alcohol company that produces, markets, and distributes popular beer, wine, and spirits brands. Founded in 1945 and headquartered in New York, the company owns exclusive U.S. rights to iconic beer brands such as Corona, Modelo, Pacifico, and Victoria.

Companies worth $10 billion or more are typically classified as “large-cap stocks,” and STZ fits the label perfectly, with its market cap exceeding this threshold, underscoring its size, influence, and dominance within the beverages-brewers industry. Its strong brand equity, diversified offerings, and dominant market position keep it a major force in the beverage industry.

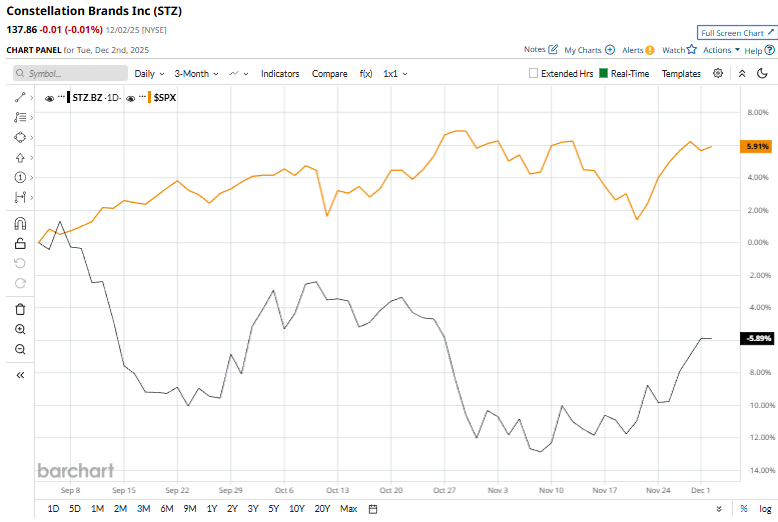

Despite its notable strength, this alcohol company has dipped 43.8% from its 52-week high of $245.31. Moreover, shares of STZ have declined 8.9% over the past three months, underperforming the S&P 500 Index ($SPX) 6.5% surge during the same time frame.

In the longer term, STZ has fallen 42% over the past 52 weeks, considerably lagging behind $SPX’s 12.9% downtick over the same time period. Moreover, on a YTD basis, shares of STZ are down 37.6%, compared to $SPX’s 16.1% drop.

To confirm its bearish trend, STZ has been trading below its 200-day moving average since last year, and has recently climbed over its 50-day moving average.

On Oct. 6, Constellation Brands reported its fiscal second-quarter results, delivering figures that slightly exceeded Wall Street expectations despite notable year-over-year declines. The company posted net sales of $2.5 billion, representing a 15% drop from the prior year, but still coming in marginally above analyst projections. Similarly, adjusted EPS fell 16% to $3.63, yet managed to beat the consensus estimate of $3.37. Despite the earnings beat, investor sentiment turned cautious, and STZ shares slipped 2.5% on the day of the announcement as markets focused more heavily on the sharp declines in both revenue and profitability.

STZ has also considerably lagged behind its rival, Anheuser-Busch InBev SA/NV (BUD), which increased 13.9% over the past 52 weeks and gained 23.1% on a YTD basis.

Despite STZ’s recent underperformance, analysts remain moderately optimistic about its prospects. The stock has a consensus rating of "Moderate Buy” from the 23 analysts covering it, and the mean price target of $169 suggests a 22.6% premium to its current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Deere Got Hit by Tariffs... Again. Should You Buy the Blue-Chip Dividend Stock on the Dip?

- The Tesla Europe Sales Rout Keeps Going. Is It Time to Sell TSLA Stock?

- Dear Nuclear Energy Stocks Fans, Mark Your Calendars for December 3

- Nvidia Just Lit a Fire Under Synopsys Stock But Its Chart Is Waving Red Flags. Here’s the Only Way I’d Trade SNPS Here.