MP Materials (MP), a cornerstone of America’s rare-earth industry, has been on a turbulent ride. Its shares peaked near the $100 mark in mid-October, fueled by fears of Chinese export restrictions, only to slide 3.57% over the past month as U.S.-China trade tensions eased. It now trades 39.7% below its 52-week high.

On Nov. 24, however, the stock staged a rebound, climbing 6.8% after BMO Capital (BMO) upgraded it from “Market Perform” to “Outperform” rating. It is the equivalent of “Buy” from “Hold,” even with a slightly reduced price target of $75 from $76. It underscores confidence in MP’s long-term strategic position despite short-term volatility.

The swing highlights a larger reality. China still controls roughly 85% of global rare-earth processing, leaving the U.S. exposed. MP’s stock swings reflect this geopolitical tightrope, suggesting that while near-term gains may be modest, the company remains central to America’s push for rare-earth independence.

Given the backdrop, the share price dip could be less of a warning and more of a potential window into a critical sector’s future.

About MP Materials Stock

Headquartered in Las Vegas, Nevada, MP Materials is the only fully integrated rare-earth producer in the U.S. Its capabilities span the entire value chain, including mining, processing, advanced metallization, and magnet manufacturing.

With a market cap hovering near the $10.3 billion mark, the company plays a central role in powering electric vehicles (EV), renewable energy systems, robotics, defense platforms, aerospace technologies, and a wide range of electronics.

Year-to-date (YTD), MP shares have surged 290%, and the past six months alone have added another 196.8%. The momentum places the stock far ahead of the broader S&P 500 Index ($SPX) which gained 16.1% YTD and 15.1% over the same six-month stretch.

Coming to valuation, MP stock currently trades at 37.39 times forward sales, a premium to its industry peers and above its own five-year average. The elevated multiple suggests that investors could be pricing in robust long-term execution.

MP Materials Surpasses Q3 Earnings

On Nov. 6, MP Materials released its Q3 2025 financial and operational results, which showcased softer revenue but stronger operational execution. Revenue fell 14.9% year-over-year (YOY) to $53.55 million, although the company still exceeded the Street’s estimate by 0.79%.

The decline did not overshadow progress in the company’s core operations. NdPr oxide production rose almost 51% YOY, indicating that MP Materials continues expanding capacity despite uneven pricing across the rare-earth market.

Profitability also showed improvement. The adjusted net loss narrowed 9.2% compared to the prior-year quarter, coming in at $17.8 million. The improvement was supported by a higher income tax benefit and increased interest income as the company’s liquidity position strengthened.

Nevertheless, MP closed the quarter with nearly $1.2 billion in cash and cash equivalents, a substantial increase from $282.4 million on Dec. 31, 2024, giving the company meaningful flexibility to invest through market cycles.

Adjusted loss came in at $0.10 per share, beating analyst expectations for a $0.14 loss. The loss per share also narrowed 16.7% YOY, reinforcing the trend of operational stabilization.

The market’s response was mixed following the earnings release. Shares declined 5.4% on Nov. 6 but rebounded 12.8% the following day as investors absorbed the stronger production metrics and improved financial footing.

Looking ahead, analysts expect Q4 fiscal year 2025 EPS to climb 157.1% YOY to $0.08. For the full fiscal 2025, loss per share is projected to narrow 41.4% to $0.34. Meanwhile, fiscal year 2026 estimates point to a meaningful earnings inflection, with EPS expected to rise 252.9% to $0.52.

What Do Analysts Expect for MP Materials Stock?

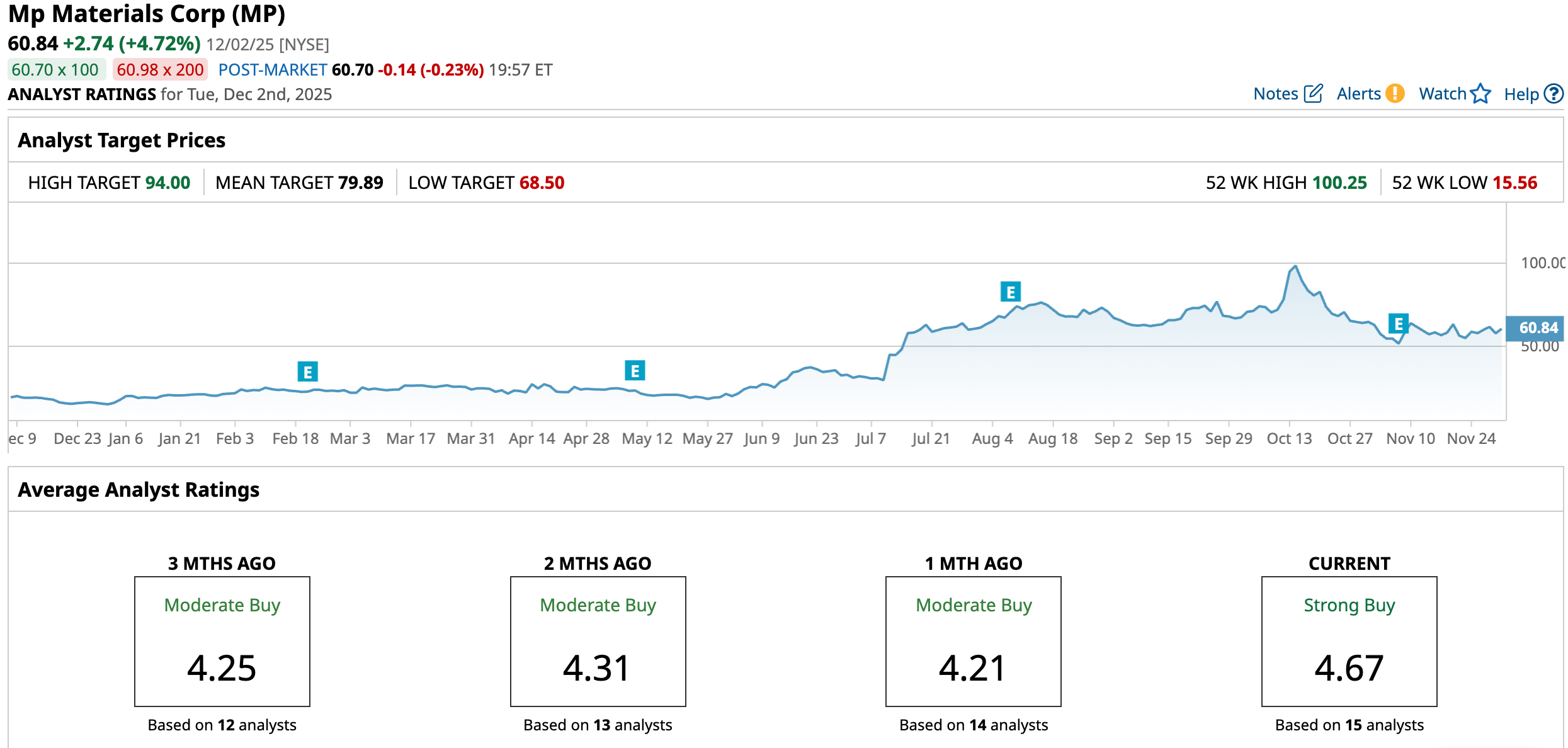

Analysts maintain a broadly constructive view of MP, assigning the stock an overall “Strong Buy” rating. Out of 15 analysts covering the company, 12 recommend “Strong Buy,” one leans toward “Moderate Buy,” and two suggest “Hold.”

MP’s average price target of $79.89 indicates potential upside of 31.3%. Meanwhile, the Street-high target of $94 implies nearly 54.5% potential appreciation from current levels.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Small-Cap Investment Firm Slumps to 52-Week Low: Opportunity or Red Flag?

- IonQ Wants to Bring Quantum Computing to Medicine. Should You Buy IONQ Stock Here?

- Jamie Dimon Once Called Bitcoin a ‘Fraud.’ Now, JPMorgan Is Quietly Making Blockchain History and Betting This ‘Crypto Winter’ Will Be Short-Lived.

- Down 41% From Its Highs, Should You Buy the Dip in MP Materials Stock?