Dan Ives is certainly one of the top analysts in the market I watch closely. I'm fully aware that Mr. Ives is among the most bullish analysts in the market. However, I think his views on many of the top high-growth tech stocks out there are meaningful, as they provide ballast to investors who (like myself) may have more of a bearish tinge to them right now.

While I'm fully aware that valuations are sky-high on a historical basis, that doesn't mean this bull market is out of steam. And Dan Ives has said as much, highlighting a few key stocks as potential outperformers in 2026, driven by what he believes will be greater buying activity for certain high-growth names at the forefront of the AI revolution.

Let's dive into one company in particular—Iren (IREN)—and why Ives is so bullish on this name in particular.

What's the Thesis?

Dan Ives suggested in his recent note that the notable AI infrastructure buildout we've seen thus far will more likely than not accelerate into 2026 and beyond. That's because he sees plenty of monetization upside from companies like Iren that are behind this revolution he sees as being transformative for the economy as a whole.

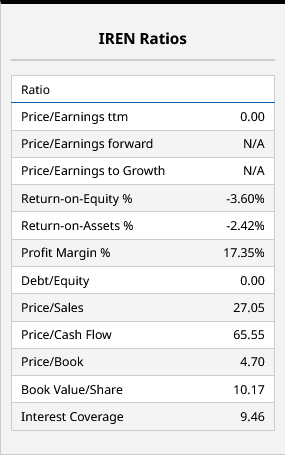

If we see the sort of tech sector growth Ives expects to see (his expectation is roughly 20% growth over the course of the next year) as AI deployments continue, there could be something to the fundamental thesis behind companies like Iren. With a positive overall profit margin and a price/cash flow ratio of about 66 times, there is a small cash flow yield of around 1.5% investors can pick up with this name right now.

Of course, IREN stock is far from cheap, trading at 27 times sales. Those are nosebleed levels, in my books.

But if this data center buildout is as big as Dan Ives and others think, perhaps this valuation is cheap relative to the future cash flow and earnings that will come investors' way. I long thought many of the top high-performance chip makers in the market were expensive before their cash flow and earnings profiles exploded. The thesis Ives and others have put forward is that it will likely be a very similar situation for data center players like Iren over time.

What Do Other Analysts Think?

Now, Dan Ives is far from the only analyst on Wall Street covering top data center names like Iren right now. In fact, there are 13 analysts covering this stock in total, and the consensus among these financial experts is that IREN stock could be headed for the $85 level over the course of the next year or so.

That's a very impressive upside of 101% from current levels if Dan Ives and others are right. With a high price target of $136 per share (implying a near-tripling of IREN stock over the same period), it's clear that most Wall Street analysts are hedging on the bullish side of the ledger right now.

That makes sense, considering the underlying growth fundamentals supporting these valuations are still in place. There's always going to be risks tied to a potential market shock that could take the whole group lower. Today's nasty 12% plus dip could be an anomaly, as none of its peers are hurting quite as much right now, and it is still up almost 50% in the last three months. But if Ives and others are correct in their view that the highly touted “AI bubble” fears are overblown, then this is a stock that growth investors will want to pay attention to here.

On the date of publication, Chris MacDonald did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- How to Use the Naked Put Options Strategy to Earn Income & Buy Stocks at a Discount

- Dan Ives Says AI Bubble Fears Are ‘Overblown’ and He’s Betting on This 1 Data Center Stock Now

- S&P Futures Tick Higher With U.S. Economic Data in Focus

- Deere Got Hit by Tariffs... Again. Should You Buy the Blue-Chip Dividend Stock on the Dip?